GWMC Property Tax Guide 2025: Payment, Rates & Benefits

Updated on : 10 April 2025

Image Source: google.com

What is GWMC Property Tax?

GWMC Property Tax is an annual tax levied by the Greater Warangal Municipal Corporation on all residential, commercial, and vacant properties. It helps fund public services like roads, sanitation, and water supply. The amount depends on property type and location.

Image Source: facebook.com

Who Needs to Pay GWMC Property Tax?

| Property Owner Type | Requirement to Pay Tax |

|---|---|

| Owners of Residential Properties | Yes, mandatory for all owned houses and flats within GWMC limits |

| Owners of Commercial Properties | Yes, applicable to shops, offices, and other commercial spaces |

| Owners of Vacant Land | Yes, if the land falls under GWMC jurisdiction |

| Government Property Owners | No, exempt if used for public purposes |

| Religious Institutions | Exempt, if used solely for religious or charitable activities |

| Tenants | No, tax is the responsibility of the property owner |

| Industrial Property Owners | Yes, if the property is used for industrial purposes |

| Builders and Developers | Yes, until property is sold to end-users |

Explore Properties in Hyderabad

- Apartments for Sale in Gajularamaram

- Apartments for Sale in Bachupally

- Apartments for Sale in Gachibowli

- Apartments for Sale in Miyapur

- Apartments for Sale in Velmula

- Apartments for Sale in Tellapur

Key Highlights of GWMC Property Tax 2025

| Feature | Description |

|---|---|

| Online Payment | Pay property tax easily through the GWMC official portal. |

| Offline Payment | Pay at designated municipal offices in Warangal. |

| Early Payment Discount | Avail rebates for timely or advance tax payments. |

| Late Payment Penalty | Delays may attract fines or interest charges. |

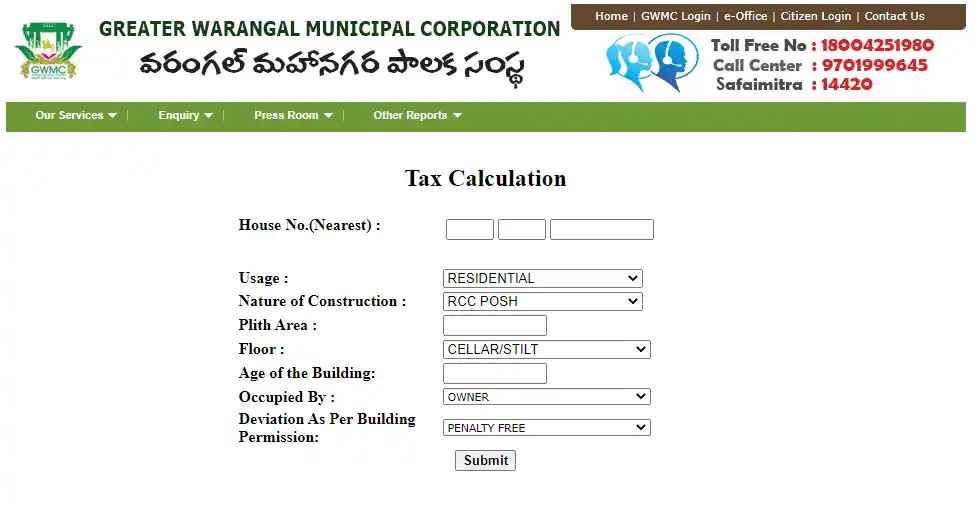

| Self-Assessment Tool | Calculate your tax online using GWMC’s tool. |

| Multiple Payment Modes | Supports UPI, cards, net banking for convenience. |

You Might Also Like

GWMC Property Tax Rates 2025

| Property Type | Tax Rate | Tax Basis |

|---|---|---|

| Residential | 25% of ARV | Annual Rental Value |

| Commercial | 33% of ARV | Annual Rental Value |

Image Source: google.com

How to Pay GWMC Property Tax Online

| Step | Action |

|---|---|

| 1 | Visit the official GWMC website |

| 2 | Click on 'Online Services' and select 'Property Tax' |

| 3 | Enter your PTIN (Property Tax Identification Number) |

| 4 | Verify property details and tax amount |

| 5 | Choose your preferred payment method (UPI, card, net banking) |

| 6 | Complete the payment and download the receipt for reference |

🏠 Looking to buy your dream home near Warangal ? 🏡 Explore top nearby properties on HexaHome & make a smart investment today! 🔑💰

Offline Payment Methods

| Method | Details |

|---|---|

| GWMC Citizen Service Centers | Visit the nearest service center and pay using cash, card, or demand draft. |

| MeeSeva Centers | Pay at authorized MeeSeva centers by providing your PTIN and property details. |

| Municipal Office | Submit your tax payment directly at the GWMC office with supporting documents. |

| Bank Branches (if applicable) | Some designated banks may accept property tax payments via challan. |

Image Source: gwmc.gov.in

🏡 Looking to rent a home near Warangal ? ✨ Explore top rental properties on HexaHome & move in hassle-free today! 🏠💼

Rebates, Penalties, and Late Fees

| Category | Details |

|---|---|

| Early Payment Rebate | Up to 5% rebate for payments made before the due date (as per GWMC policy). |

| Senior Citizen Rebate | Available for eligible senior citizens on self-occupied residential properties. |

| Penalty for Late Payment | 2% monthly penalty on outstanding tax after the due date. |

| Interest Charges | May be levied in addition to penalties for prolonged non-payment. |

| No Rebate After Due Date | Rebate benefits lapse if payment is delayed beyond the due date. |

| Special Rebate Announcements | Occasionally offered during drives or government schemes. |

How to Get a Property Tax Receipt

| Step | Action |

|---|---|

| 1 | Visit the official GWMC website |

| 2 | Navigate to 'Online Services' > 'Property Tax' section |

| 3 | Click on 'Download Receipt' or 'Payment History' option |

| 4 | Enter your PTIN or transaction ID |

| 5 | Select the relevant payment entry from the list |

| 6 | Download or print the receipt for your records |

🏢 Looking to buy commercial space near Warangal ? 🚀 Discover top office & retail properties on HexaHome to grow your business smartly! 💼🏙️

Steps to File a Complaint or Raise Queries

| Step | Action |

|---|---|

| 1 | Visit the official GWMC website |

| 2 | Go to the 'Grievance' or 'Contact Us' section from the homepage |

| 3 | Select 'Property Tax' as the complaint category |

| 4 | Fill in your details, PTIN, and describe your issue clearly |

| 5 | Attach any relevant documents or payment proof, if required |

| 6 | Submit the form and note the reference number for tracking |

Explore Properties in Hyderabad

- Apartments for Sale in Gajularamaram

- Apartments for Sale in Bachupally

- Apartments for Sale in Gachibowli

- Apartments for Sale in Miyapur

- Apartments for Sale in Velmula

- Apartments for Sale in Tellapur

FAQs

Que: How to check dues online?

Ans: Use your Property ID (PTIN) on the GWMC portal to check pending dues and payment status.

Que: What is PTIN in GWMC Property Tax?

Ans: PTIN stands for Property Tax Identification Number, a unique ID assigned to each property for tax purposes.

Que: Can I pay GWMC Property Tax without PTIN?

Ans: No, PTIN is mandatory to fetch property details and make payments online or offline.

Que: Is there a rebate for early payment?

Ans: Yes, GWMC offers up to 5% rebate for property tax payments made before the due date.

Que: What happens if I miss the payment deadline?

Ans: A penalty of 2% per month may be levied on the outstanding tax amount after the due date.

Que: Can I download the receipt after payment?

Ans: Yes, after payment, you can download the receipt anytime from the GWMC website using your PTIN or transaction ID.

India's Best Real Estate Housing App

Scan to Download the app

Explore Properties for Sale in Hyderabad:

- Apartments for Sale in Gajularamaram Hyderabad

- Apartments for Sale in Bachupally Hyderabad

- Apartments for Sale in Gachibowli Hyderabad

- Apartments for Sale in Miyapur Hyderabad

- Apartments for Sale in Velmula Hyderabad

- Apartments for Sale in Tellapur Hyderabad

- Apartments for Sale in Narsingi Hyderabad

- Apartments for Sale in Begumpet Hyderabad

- Apartments for Sale in Satamrai Hyderabad

- Apartments for Sale in Shamshabad Hyderabad

- Villa for Sale in Patancheru Hyderabad

- Villa for Sale in Serilingampally Hyderabad

- Villa for Sale in Badesahebguda Hyderabad

- Villa for Sale in Peerzadiguda Hyderabad

- Villa for Sale in Korremul Hyderabad

- Office Space for Sale in Hi Tech City Hyderabad

- Builder Floors for Sale in Gajularamaram Hyderabad

Explore Properties for Rent in Hyderabad:

- Apartments for Rent in Madhapur Hyderabad

- Apartments for Rent in Kondapur Hyderabad

- Apartments for Rent in Gachibowli Hyderabad

- Apartments for Rent in Manikonda Hyderabad

- Apartments for Rent in Serilingampally Hyderabad

- Apartments for Rent in Tellapur Hyderabad

- Apartments for Rent in Nanakaramguda Hyderabad

- Apartments for Rent in Subhash Nagar Colony Hyderabad

- Apartments for Rent in Miyapur Hyderabad

- Apartments for Rent in Adibatla Hyderabad

- Builder Floors for Rent in Lakdikapul Hyderabad

- Builder Floors for Rent in Hafeezpet Hyderabad

- Office Space for Rent in Gachibowli Hyderabad

- Office Space for Rent in Madhapur Hyderabad

- Villa for Rent in Miyapur Hyderabad

- House for Rent in Borabanda Hyderabad

Explore Plots for sale in Hyderabad:

- Plot for Sale Chandrayangutta Hyderabad

- Plot for Sale Balanagar Hyderabad

- Plot for Sale Ameerpet Hyderabad

- Plot for Sale Malkapur Hyderabad

- Plot for Sale Peerzadiguda Hyderabad

- Plot for Sale Shamshabad Hyderabad

- Plot for Sale Ghatkesar Hyderabad

- Plot for Sale Dilsukh Nagar Hyderabad

- Plot for Sale Hyder Nagar Hyderabad

- Plot for Sale Khairatabad Hyderabad

- Commercial Plot for Sale in Ameerpet Hyderabad

Explore PG’s for Rent in Hyderabad:

- PG’s for Rent in Manikonda Hyderabad

- PG’s for Rent in Gachibowli Hyderabad

- PG’s for Rent in Jubilee Hills Hyderabad

- PG’s for Rent in Borabanda Hyderabad

- PG’s for Rent in Banjara Hills Hyderabad

- PG’s for Rent in Himayat Nagar Hyderabad

- PG’s for Rent in Narayan Guda Hyderabad

- PG’s for Rent in Mehdipatnam Hyderabad

- PG’s for Rent in Madhapur Hyderabad

- PG’s for Rent in Ramchandrapuram Hyderabad

Explore Co-living options in Hyderabad:

- Sharing Room/Flats in Kondapur Hyderabad

- Sharing Room/Flats in Gachibowli Hyderabad

- Sharing Room/Flats in Manikonda Hyderabad

- Sharing Room/Flats in Madhapur Hyderabad

- Sharing Room/Flats in Narsingi Hyderabad

- Sharing Room/Flats in Hafeezpet Hyderabad

- Sharing Room/Flats in Banjara Hills Hyderabad

- Sharing Room/Flats in Nanakaramguda Hyderabad

- Sharing Room/Flats in Chanda Nagar Hyderabad

- Sharing Room/Flats in Serilingampally Hyderabad

- Sharing Room/Flats in Manikonda Hyderabad

- Sharing Room/Flats in Kompally Hyderabad

- Sharing Room/Flats in Mansoorabad Hyderabad

- Sharing Room/Flats in Gachibowli Hyderabad

Buy, Sell & Rent Properties – Download HexaHome App Now!

Find your perfect home, PG, or rental in just a few clicks.

Post your property at ₹0 cost and get genuine buyers & tenants fast

Smart alerts & search helps you find homes that fit your budget.

Available on iOS & Android

A Product By Hexadecimal Software Pvt. Ltd.