PMC Property Tax Pune 2025: All You Need to Know

Updated on : 18 June 2025

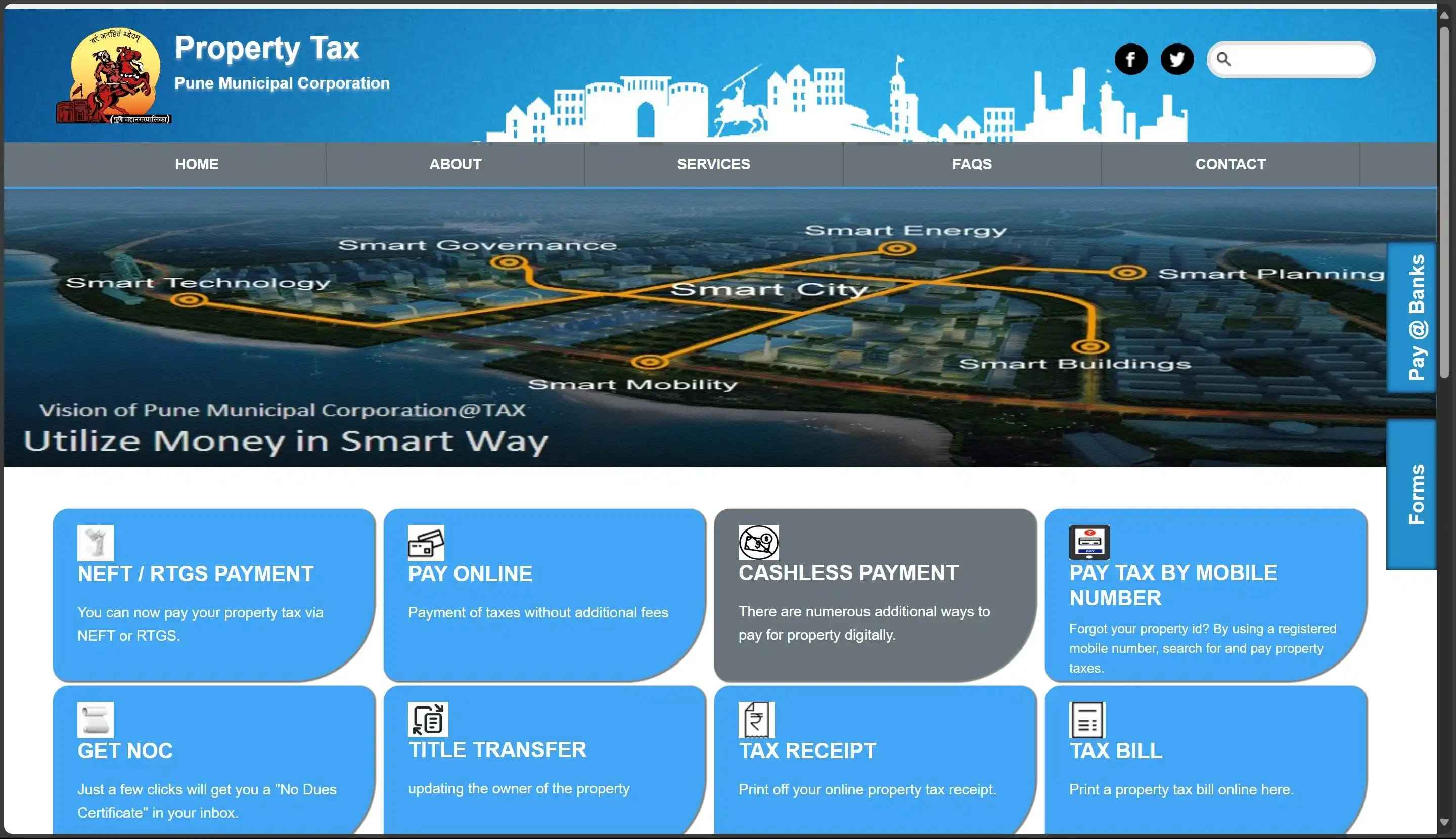

Image Source: google.com

What is PMC Property Tax?

PMC Property Tax is a municipal tax collected by the Pune Municipal Corporation from property owners. The tax supports civic amenities such as garbage collection, sewage, road maintenance, and lighting.

Image Source: google.com

Explore Properties in Pune

- Apartments for Sale in Kharadi

- Apartments for Sale in Vishrantwadi

- Apartments for Sale in Wadgaon Sheri

- Apartments for Sale in KHARADI

- Apartments for Sale in Undri

- Apartments for Sale in Narhe

Who Has to Pay Property Tax in Pune?

| Category | Description |

|---|---|

| 🏠 Residential Property Owners | Owners of houses, apartments, or flats within PMC limits. |

| 🏢 Commercial Property Owners | Shops, offices, showrooms, etc. |

| 🏭 Industrial Units | Factories and manufacturing setups. |

| 🏥 Institutional Owners | Hospitals, schools, colleges, and trusts. |

PMC Property Tax Rates 2025

| Type | Rate (per sq. ft.) |

|---|---|

| Residential (Self-Occupied) | ₹2 – ₹6 depending on the zone |

| Residential (Rented) | ₹4 – ₹12 depending on the zone |

| Commercial | ₹10 – ₹25 depending on property type and zone |

| Industrial | ₹8 – ₹20 |

| Vacant Land | Based on market value & usage |

How to Calculate Property Tax in Pune

| Factor | Description |

|---|---|

| 📏 Built-up Area | Total constructed space |

| 📍 Zone | Location category as defined by PMC |

| 🏠 Property Use | Residential, Commercial, Industrial, etc. |

| 🏗️ Construction Type | Pucca or Kachcha |

| 🕒 Age Factor | Older buildings may attract less tax |

Property Tax = Rate × Built-up Area × Zone Factor × Usage Factor × Age Factor👉 For exact calculation, visit the official PMC website.

You Might Also Like

Paying PMC Property Tax Online: Step-by-Step

| Step | Action | Details |

|---|---|---|

| 1 | Go to PMC Portal | Visit PMC Property Tax Website |

| 2 | Search Property | Use your Property ID or Owner Name to locate details. |

| 3 | Verify Details | Confirm your outstanding amount, property address, and ID. |

| 4 | Choose Payment | Select online payment method (UPI, card, net banking). |

| 5 | Make Payment | Complete the transaction online. |

| 6 | Download Receipt | Save the receipt for future records. |

Important Dates and Late Fees

| Item | Details |

|---|---|

| 🗓️ Annual Deadline | Generally May 31st each year (subject to changes) |

| 💸 Early Payment Rebate | Up to 10% rebate if paid before April 30th |

| ⚠️ Late Fee | 2% monthly penalty on the due amount |

| 🔁 Reminder Notice | Issued post-deadline to defaulters |

| 🚫 Legal Action | Persistent non-payment may lead to recovery proceedings |

Rebates and Exemptions

| Category | Rebate/Exemption |

|---|---|

| 👵 Senior Citizens | 10% rebate on self-occupied property |

| ♿ PwDs | Up to 15% concession |

| 🏫 Charitable Trusts | Full/partial exemptions based on usage |

| 🕌 Religious Buildings | Usually exempt from tax |

| 🏠 Timely Payers | Rebates up to 10% for early payment |

Check Outstanding Dues on PMC Portal

| Step | Action |

|---|---|

| 1️⃣ | Visit PMC Property Tax Portal |

| 2️⃣ | Click on 'Search Property Details' |

| 3️⃣ | Enter your Property Code or Owner Name |

| 4️⃣ | Click on 'Submit' |

| 5️⃣ | View tax dues, receipts, and payment history |

Image Source: punecorporation.org

PMC Helpline and Support

| Department | Contact |

|---|---|

| PMC Main Office | PMC Building, Shivajinagar, Pune – 411005 📞 020-25501000 |

| Property Tax Department | 📞 020-25501116, ✉️ pmcpropertytax@punecorporation.org |

| Online Portal Support | 📞 1800-103-0222 (Toll-Free) |

| Official Website | punecorporation.org |

Explore Properties in Pune

- Apartments for Sale in Kharadi

- Apartments for Sale in Vishrantwadi

- Apartments for Sale in Wadgaon Sheri

- Apartments for Sale in KHARADI

- Apartments for Sale in Undri

- Apartments for Sale in Narhe

FAQs

Q: How can I pay Pune property tax online?

Ans. Visit propertytax.punecorporation.org, search your property and pay via UPI/net banking/card.

Q: What is the rebate for early payment?

Ans. PMC offers up to 10% rebate for payments made before April 30th.

Q: What if I miss the deadline?

Ans. A 2% monthly penalty is levied on unpaid dues.

Q: Are any properties exempt from tax?

Ans. Religious buildings, charitable trusts, and senior citizen-owned homes may qualify for exemptions.

Q: Where can I raise a complaint?

Ans. Contact PMC's helpline at 1800-103-0222

India's Best Real Estate Housing App

Scan to Download the app

Explore Properties for Sale in Pune:

- Apartments for Sale in Kharadi Pune

- Apartments for Sale in Vishrantwadi Pune

- Apartments for Sale in Wadgaon Sheri Pune

- Apartments for Sale in KHARADI Pune

- Apartments for Sale in Undri Pune

- Apartments for Sale in Narhe Pune

- Apartments for Sale in Mohammadwadi Pune

- Apartments for Sale in Aundh Pune

- Apartments for Sale in Ganga Dham Pune

- Apartments for Sale in Dhanori Pune

- Office Space for Sale in Hinjawadi Pune

- Office Space for Sale in Baner Pune

- Retail Shop for Sale in Baner Pune

Explore Properties for Rent in Pune:

- Apartments for Rent in Baner Pune

- Apartments for Rent in Kharadi Pune

- Apartments for Rent in Balewadi Pune

- Apartments for Rent in Shivaji Nagar Pune

- Apartments for Rent in Hadapsar Pune

- Apartments for Rent in Lohegaon Pune

- Apartments for Rent in Kothrud Pune

- Apartments for Rent in Dhanori Pune

- Apartments for Rent in Mundhwa Pune

- Apartments for Rent in Kalyani Nagar Pune

- 1 Rk Studio for Rent in Hadapsar Pune

- Villa for Rent in Manjari Budruk Pune

- Office Space for Rent in Baner Pune

- Builder Floors for Rent in Lohegaon Pune

Explore PG’s for Rent in Pune:

- PG’s for Rent in Hadapsar Pune

- PG’s for Rent in Baner Pune

- PG’s for Rent in Wagholi Pune

- PG’s for Rent in Punawale Pune

- PG’s for Rent in Kothrud Pune

- PG’s for Rent in Hinjawadi Pune

- PG’s for Rent in Kalyani Nagar Pune

- PG’s for Rent in Shivaji Nagar Pune

- PG’s for Rent in Kharadi Pune

- PG’s for Rent in Rasta Peth Pune

Explore Co-living options in Pune:

- Sharing Room/Flats in Baner Pune

- Sharing Room/Flats in Hadapsar Pune

- Sharing Room/Flats in Kothrud Pune

- Sharing Room/Flats in Keshavnagar Pune

- Sharing Room/Flats in Balewadi Pune

- Sharing Room/Flats in Ambegaon Khurd Pune

- Sharing Room/Flats in Lohegaon Pune

- Sharing Room/Flats in Kharadi Pune

- Sharing Room/Flats in Shaniwar Peth Pune

- Sharing Room/Flats in Bopodi Pune

- Sharing Room/Flats in Wadgaon Sheri Pune

Buy, Sell & Rent Properties – Download HexaHome App Now!

Find your perfect home, PG, or rental in just a few clicks.

Post your property at ₹0 cost and get genuine buyers & tenants fast

Smart alerts & search helps you find homes that fit your budget.

Available on iOS & Android

A Product By Hexadecimal Software Pvt. Ltd.