Stamp Duty Registration Charges in Bangalore

Updated on : 06 March 2025

Image Source: google.com

Stamp duty and registration charges in Bangalore in 2025

| Property Type | Stamp Duty Rate | Registration Charges | Gender-Specific Concessions | Additional Information |

|---|---|---|---|---|

| Residential (Above ₹45 lakh) - Male | 5% | 1% | No concessions | No special discounts |

| Residential (Above ₹45 lakh) - Female | 5% | 1% | No concessions in Bangalore | No special discounts |

| Residential (Between ₹21 lakh and ₹45 lakh) - Male | 3% | 1% | No concessions | No special discounts |

| Residential (Between ₹21 lakh and ₹45 lakh) - Female | 3% | 1% | No concessions in Bangalore | No special discounts |

| Residential (Below ₹20 lakh) - Male | 2% | 1% | No concessions | No special discounts |

| Residential (Below ₹20 lakh) - Female | 2% | 1% | No concessions in Bangalore | No special discounts |

| Commercial - Male | 5% | 1% | No concessions | No special discounts |

| Commercial - Female | 5% | 1% | No concessions in Bangalore | No special discounts |

| Plots and Agricultural Land - Male | 5% | 1% | No concessions | No special discounts |

| Plots and Agricultural Land - Female | 5% | 1% | No concessions in Bangalore | No special discounts |

| Affordable Housing (Below ₹45 lakh) - Male | 2-3% | 1% | No concessions | Potential for lower rates |

| Affordable Housing (Below ₹45 lakh) - Female | 2-3% | 1% | No concessions in Bangalore | Potential for lower rates |

| Under-Construction Properties - Male | 5% Stamp Duty + GST | 1% | No concessions | GST applies |

| Under-Construction Properties - Female | 5% Stamp Duty + GST | 1% | No concessions in Bangalore | GST applies |

| Property Listings in Bangalore |

|---|

| Residential Buy Property in Bangalore, Karnataka |

| Residential Rent Property in Bangalore, Karnataka |

| Residential Plot Property in Bangalore, Karnataka |

Explore Properties in Bengaluru

- House for Sale in Begur

- House for Sale in Yelenahalli

- House for Sale in Kallabalu

- House for Sale in Nelagadaranahalli

- House for Sale in Hebbal

- House for Sale in Konankunte

- House for Sale in MS Palya

- House for Sale in Jigani

- House for Sale in Suragijakkanahalli

- House for Sale in Chandapura

- Apartments for Sale in Electronic City

- Apartments for Sale in White Field

- Apartments for Sale in Yelahanka

- Apartments for Sale in Whitefield

- Apartments for Sale in Krishnarajapuram

- Apartments for Sale in Gunjur

- Apartments for Sale in Hal

- Apartments for Sale in Bannerghatta

Calculate Stamp Duty and Registration Charges in Bangalore, Karnataka

| Property Type | Stamp Duty Rate | Registration Charges | Additional Charges | Total Charges Example |

|---|---|---|---|---|

| Residential (Above ₹45 lakh) - Male | 5% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 5.6% Stamp Duty + 1% Registration |

| Residential (Above ₹45 lakh) - Female | 5% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 5.6% Stamp Duty + 1% Registration |

| Residential (Between ₹21 lakh and ₹45 lakh) - Male | 3% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 3.32% Stamp Duty + 1% Registration |

| Residential (Between ₹21 lakh and ₹45 lakh) - Female | 3% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 3.32% Stamp Duty + 1% Registration |

| Residential (Below ₹20 lakh) - Male | 2% | 1% | No additional charges | 2% Stamp Duty + 1% Registration |

| Residential (Below ₹20 lakh) - Female | 2% | 1% | No additional charges | 2% Stamp Duty + 1% Registration |

| Commercial - Male | 5% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 5.6% Stamp Duty + 1% Registration |

| Commercial - Female | 5% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 5.6% Stamp Duty + 1% Registration |

| Plots and Agricultural Land - Male | 5% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 5.6% Stamp Duty + 1% Registration |

| Plots and Agricultural Land - Female | 5% + 10% Cess + 2% Surcharge | 1% | Cess: 10%, Surcharge: 2% | 5.6% Stamp Duty + 1% Registration |

| Property Listings in Bangalore |

|---|

| Residential Buy Property in Bangalore, Karnataka |

| Residential Rent Property in Bangalore, Karnataka |

| Residential Plot Property in Bangalore, Karnataka |

Stamp Duty and Registration Charges in Bangalore for Different Deed Types

| Deed Type | Stamp Duty | Registration Charges | Additional Information |

|---|---|---|---|

| Sale Deed | 5% of Market Value for properties above ₹45 lakh, 3% for ₹21-45 lakh, 2% below ₹20 lakh | 1% of Property Value | Cess: 10% of Stamp Duty, Surcharge: 2% in urban areas |

| Gift Deed (Family Members) | Fixed charges | 1% of Property Value | Specific rates may vary |

| Joint Development Agreement | 1% of Market Value, Max ₹15 lakhs | 1% of Property Value, Max ₹1.5 lakhs | Applies to immovable property sales |

| Conveyance Deed | 5% of Market Value + Additional Duty + Surcharge | 1% of Property Value | Similar to sale deed charges |

| Rental Agreement | 0.5% for less than 1 year, varies by lease duration | Varies by lease duration | Specific rates apply based on lease terms |

| Cancellation Deed | Same duty as original instrument | Rs. 100 or 1% of Market Value | Depends on original agreement type |

| Adoption Deed | Rs. 500 | Rs. 200 | Fixed charges apply |

| Affidavit | Rs. 20 | NA | No registration fee applicable |

| Agreement for Sale (with possession) | 5% of Market Value | 1% of Property Value | Similar to sale deed charges |

| Agreement for Sale (without possession) | 0.1% of Market Value | Min. Rs. 100, Max. Rs. 20,000 | Lower rates apply |

Tax Benefits on Stamp Duty and Registration Charges

-

Eligibility: The property must be registered in the buyer's name, and the payment must be made in the same financial year.

-

Deduction Limit: Up to ₹1,50,000 per year can be claimed as a deduction under Section 80C for stamp duty and registration charges.

-

Applicability: This benefit is available only for new homes and not for commercial properties, residential plots, or resale properties.

-

Joint Ownership: Co-owners can claim these expenses in their Income Tax Returns (ITRs) based on their share in the property.

-

Documentation: Actual expenses incurred for stamp duty and registration charges must be documented and substantiated to qualify for tax benefits.

| Tax Benefit Criteria | Eligibility | Deduction Limit | Applicability |

|---|---|---|---|

| Section 80C Deduction | Property registered in buyer's name, payment in the same financial year | Up to ₹1,50,000 per year | New homes only |

| Joint Ownership Benefits | Co-owners can claim based on their share | Up to ₹1,50,000 per year | Jointly owned new homes |

| Excluded Properties | Commercial, resale, residential plots | No deduction available | Not applicable |

| Documentation Requirement | Actual expenses must be documented | Up to ₹1,50,000 per year | All eligible properties |

| Property Listings in Bangalore |

|---|

| Residential Buy Property in Bangalore, Karnataka |

| Residential Rent Property in Bangalore, Karnataka |

| Residential Plot Property in Bangalore, Karnataka |

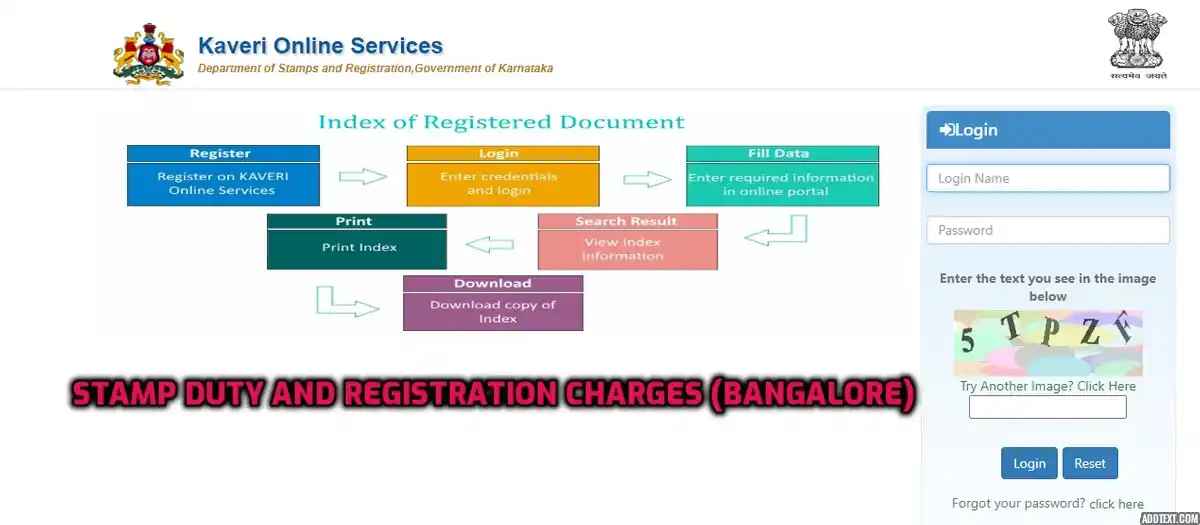

To pay stamp duty and registration charges online in Bangalore

- Visit the Kaveri Online Services Portal: Go to the official Kaveri portal.

Image Source: Google

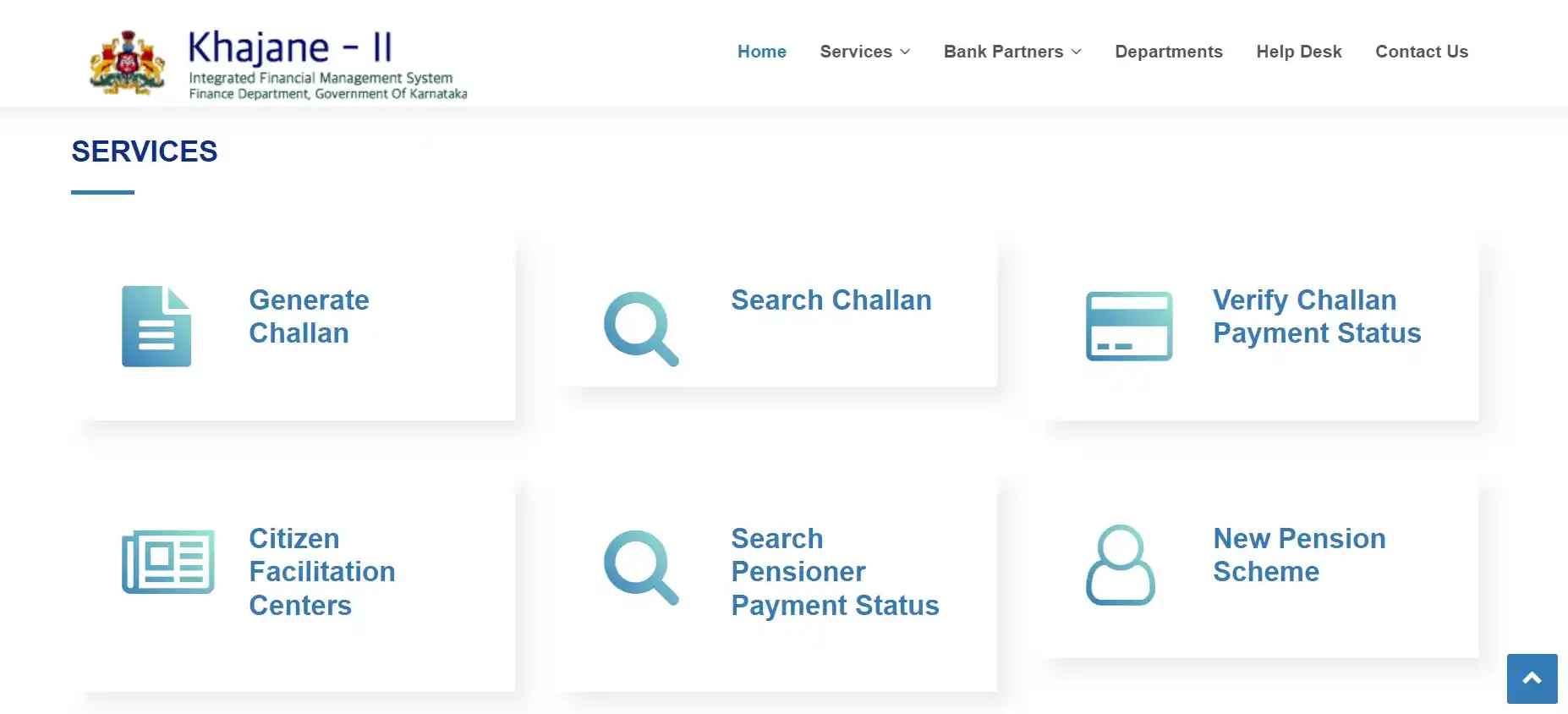

- Generate Challan: Click on 'Generate Challan' to start the payment process.

Image Source: Google

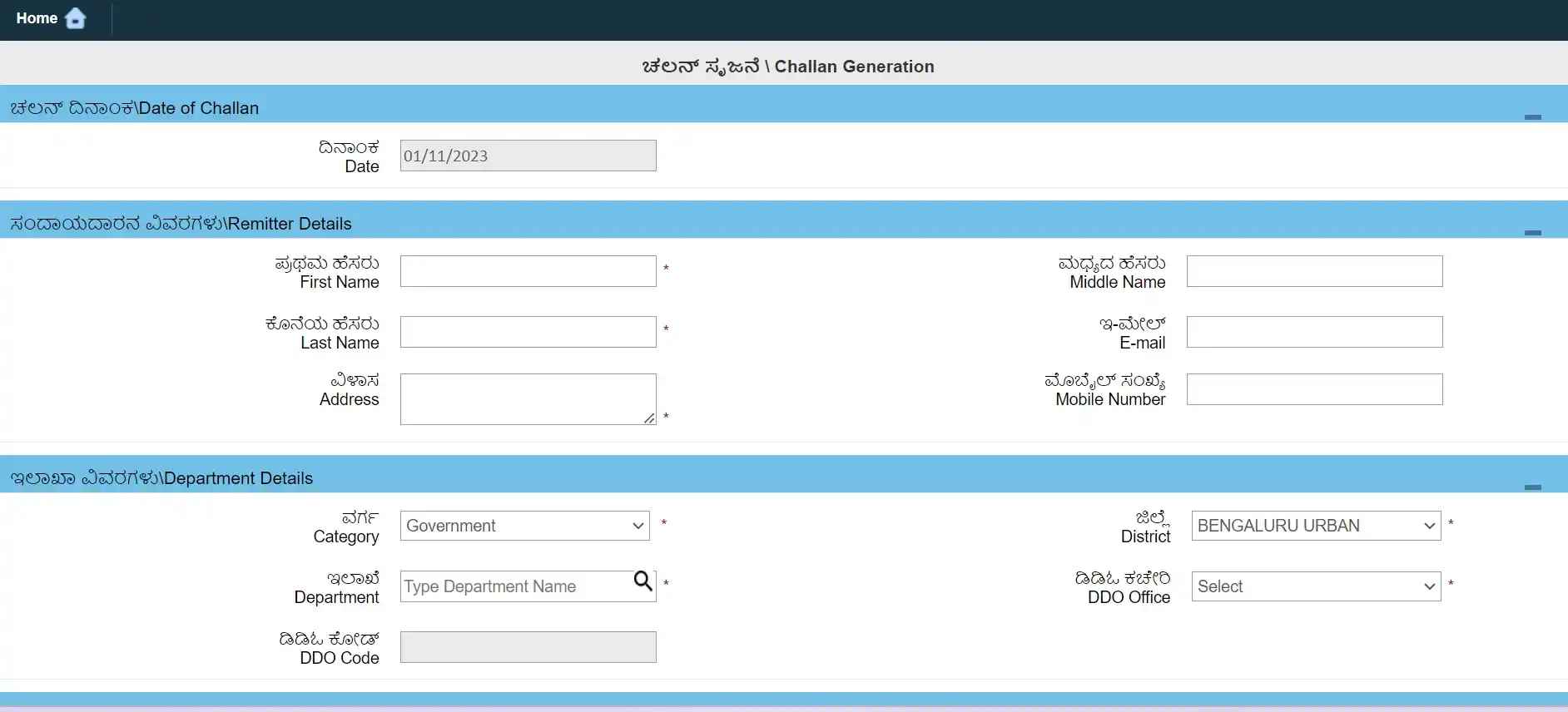

- Enter Property Details: Fill in relevant details such as property address, market value, and type (residential/commercial).

Image Source: Google

-

Select Payment Type: Choose the stamp duty and registration charges applicable based on the property value.

-

Mode of Payment: Select your preferred payment method (Net Banking, Credit/Debit Card).

-

Submit and Receive Challan: After completing the payment, a challan will be generated. This challan is valid for 90 days for property registration.

-

Complete Registration: Present the challan at the sub-registrar's office to complete the registration of your property.

To Pay Stamp Duty and Property Registration Charges Offline in Bangalore

-

Visit the Local Sub-Registrar's Office: Go to the sub-registrar's office in your jurisdiction with all necessary documents.

-

Calculate Charges: Officials will help calculate the stamp duty and registration charges based on the property value.

-

Payment Methods:

Pay using:

-

Demand Draft: Drawn in favor of the respective Sub Registrar of Assurances.

-

Cash: For amounts below ₹2,000.

-

Cheque: From a nationalized bank.

-

-

Impressed Stamps: For amounts above ₹2,000, purchase these from the treasury or authorized vendors124.

-

Document Verification: Ensure both the buyer and seller, along with any required witnesses, are present to sign the documents.

-

Registration Process: After payment and verification, the property registration certificate will be issued14.

Steps to apply for a Stamp Duty Refund in Bangalore

-

Check Eligibility: Ensure you meet refund criteria (e.g., cancelled transaction, unused stamps).

-

Gather Documents: Original deed, cancellation deed, proof of unused stamps, bank details, ID proof.

-

Application Form: Use Form 4 for stamp duty refund.

-

Submit Application: Fill out form, attach documents, submit to District Collector or Sub-Registrar.

-

Verification and Refund: Authorities verify application; refund processed with a possible 10% deduction.

Contact Details for Stamp Duty and Registration Charges in Bangalore

| Office | Address | Phone | Email/Website |

|---|---|---|---|

| Department of Stamps and Registration | Kandaaya Bhavan, 8th floor, K G Road, Bengaluru-560 009 | 080-22220436 | aigrcomp@karnataka.gov.in |

| Sub-Registrar Offices | Various locations across Bangalore | Varies by location | Check local directories |

| Kaveri Online Services Portal | N/A | N/A | kaverionline.karnataka.gov.in |

| Property Listings in Bangalore |

|---|

| Residential Buy Property in Bangalore, Karnataka |

| Residential Rent Property in Bangalore, Karnataka |

| Residential Plot Property in Bangalore, Karnataka |

Explore Properties in Bengaluru

- House for Sale in Begur

- House for Sale in Yelenahalli

- House for Sale in Kallabalu

- House for Sale in Nelagadaranahalli

- House for Sale in Hebbal

- House for Sale in Konankunte

- House for Sale in MS Palya

- House for Sale in Jigani

- House for Sale in Suragijakkanahalli

- House for Sale in Chandapura

- Apartments for Sale in Electronic City

- Apartments for Sale in White Field

- Apartments for Sale in Yelahanka

- Apartments for Sale in Whitefield

- Apartments for Sale in Krishnarajapuram

- Apartments for Sale in Gunjur

- Apartments for Sale in Hal

- Apartments for Sale in Bannerghatta

FAQs

Q. What are the stamp duty rates in Bangalore?

Stamp duty rates in Bangalore are 2% for properties below ₹20 lakh, 3% for properties between ₹21 lakh and ₹45 lakh, and 5% for properties above ₹45 lakh.Q. What are the registration charges in Bangalore?

Registration charges in Bangalore are 1% of the property value.Q. Are there any additional charges?

Yes, there is a 10% cess and a surcharge of 2% in urban areas (or 3% in rural areas) on the stamp duty.Q. How can I pay stamp duty and registration charges in Bangalore?

You can pay online via the Kaveri portal or offline at the sub-registrar's office using demand drafts, cash, or cheques.Q. Are there any special rates for women or first-time buyers?

No, there are no special rates for women or first-time buyers in Bangalore; the rates apply uniformly.India's Best Real Estate Housing App

Scan to Download the app

Explore Properties for Sale in Bengaluru:

- House for Sale in Begur Bengaluru

- House for Sale in Yelenahalli Bengaluru

- House for Sale in Kallabalu Bengaluru

- House for Sale in Nelagadaranahalli Bengaluru

- House for Sale in Hebbal Bengaluru

- House for Sale in Konankunte Bengaluru

- House for Sale in MS Palya Bengaluru

- House for Sale in Jigani Bengaluru

- House for Sale in Suragijakkanahalli Bengaluru

- House for Sale in Chandapura Bengaluru

- Apartments for Sale in Electronic City Bengaluru

- Apartments for Sale in White Field Bengaluru

- Apartments for Sale in Yelahanka Bengaluru

- Apartments for Sale in Whitefield Bengaluru

- Apartments for Sale in Krishnarajapuram Bengaluru

- Apartments for Sale in Gunjur Bengaluru

- Apartments for Sale in Hal Bengaluru

- Apartments for Sale in Bannerghatta Bengaluru

- Apartments for Sale in Horamavu Bengaluru

- Apartments for Sale in Banswadi Bengaluru

- Villa for Sale in Kithaganur Bengaluru

- Villa for Sale in Devanahalli Bengaluru

- Villa for Sale in Mylasandra Bengaluru

- Villa for Sale in Hebbal Bengaluru

- Villa for Sale in Kaggalipur Bengaluru

- Villa for Sale in Dasanapura Bengaluru

- Villa for Sale in Bannerghatta Bengaluru

- Villa for Sale in Krishnarajapuram Bengaluru

- Retail Shop for Sale in Whitefield Bengaluru

- Office Space for Sale in Whitefield Bengaluru

Explore Properties for Rent in Bengaluru:

- Apartments for Rent in HSR Layout Bengaluru

- Apartments for Rent in Electronic City Bengaluru

- Apartments for Rent in Koramangala Bengaluru

- Apartments for Rent in C V Raman Nagar Bengaluru

- Apartments for Rent in Varthur Bengaluru

- Apartments for Rent in Hulimavu Bengaluru

- Apartments for Rent in White Field Bengaluru

- Apartments for Rent in Kasavanahalli Bengaluru

- Apartments for Rent in Bellandur Bengaluru

- Apartments for Rent in Whitefield Bengaluru

- Builder Floors for Rent in HSR Layout Bengaluru

- Builder Floors for Rent in Singasandra Bengaluru

- Builder Floors for Rent in Begur Bengaluru

- Builder Floors for Rent in Nelagadaranahalli Bengaluru

- Builder Floors for Rent in Rajarajeshwari Nagar Bengaluru

- Builder Floors for Rent in Abbigere Bengaluru

- Builder Floors for Rent in Ilyas Nagar Layout Bengaluru

- 1 Rk Studio for Rent in Jalahalli West Bengaluru

- 1 Rk Studio for Rent in K P Agrahara Bengaluru

- 1 Rk Studio for Rent in Abbigere Bengaluru

- House for Rent in HSR Layout Bengaluru

- House for Rent in Jigani Bengaluru

- House for Rent in Bennigana Halli Bengaluru

- Office Space for Rent in Mathikere Bengaluru

Explore Plots for sale in Bengaluru:

- Plot for Sale Jigani Bengaluru

- Plot for Sale Ramohalli Bengaluru

- Plot for Sale J P Nagar Bengaluru

- Plot for Sale Doddaladamara Bengaluru

- Plot for Sale Banashankari Bengaluru

- Plot for Sale Kaggalipur Bengaluru

- Plot for Sale Chunchanakuppe Bengaluru

- Plot for Sale Udayapura Bengaluru

- Plot for Sale Chandapura Bengaluru

- Plot for Sale Jakkur Bengaluru

- Commercial Plot for Sale in J P Nagar Bengaluru

- Commercial Plot for Sale in Jigani Bengaluru

- Commercial Plot for Sale in Devarabisanahalli Bengaluru

- Commercial Plot for Sale in Begur Bengaluru

- Commercial Plot for Sale in Hulimavu Bengaluru

- Commercial Plot for Sale in Anjanapura Bengaluru

- Commercial Plot for Sale in Kaglipur Bengaluru

Explore PG’s for Rent in Bengaluru:

- PG’s for Rent in Electronic City Bengaluru

- PG’s for Rent in Koramangala Bengaluru

- PG’s for Rent in HSR Layout Bengaluru

- PG’s for Rent in BTM Layout Bengaluru

- PG’s for Rent in Jayanagar Bengaluru

- PG’s for Rent in Banashankari Bengaluru

- PG’s for Rent in Sanjay Nagar Bengaluru

- PG’s for Rent in Shanti Nagar Bengaluru

- PG’s for Rent in Rajaji Nagar Bengaluru

- PG’s for Rent in Kumaraswamy Layout Bengaluru

Explore Co-living options in Bengaluru:

- Sharing Room/Flats in Bellandur Bengaluru

- Sharing Room/Flats in Kadugodi Bengaluru

- Sharing Room/Flats in Mahadevapura Bengaluru

- Sharing Room/Flats in Doddakannelli Bengaluru

- Sharing Room/Flats in C V Raman Nagar Bengaluru

- Sharing Room/Flats in Kasavanahalli Bengaluru

- Sharing Room/Flats in Nagapur Bengaluru

- Sharing Room/Flats in J P Nagar Bengaluru

- Sharing Room/Flats in Chikka Thogu Bengaluru

- Sharing Room/Flats in Hoodi Bengaluru

- Sharing Room/Flats in HSR Layout Bengaluru

- Sharing Room/Flats in Whitefield Bengaluru

- Sharing Room/Flats in Indira Nagar Bengaluru

- Sharing Room/Flats in Bellandur Bengaluru

- Sharing Room/Flats in BTM Layout Bengaluru

Buy, Sell & Rent Properties – Download HexaHome App Now!

Find your perfect home, PG, or rental in just a few clicks.

Post your property at ₹0 cost and get genuine buyers & tenants fast

Smart alerts & search helps you find homes that fit your budget.

Available on iOS & Android

A Product By Hexadecimal Software Pvt. Ltd.