TDS on Property Sales in India– Applicability, Rates & Filing Process

Updated on : 07 February 2025

Image Source: Google.com

Introduction to TDS on Property Sales

Tax Deducted at Source (TDS) ensures tax collection at the source in high-value transactions. Under Section 194-IA of the Income Tax Act, 1961, buyers must deduct 1% TDS if the property value exceeds ₹50 lakh, including charges like club membership, parking, and maintenance fees. No TDS is required for properties below ₹50 lakh.

For installment-based payments, TDS is deducted proportionally with each payment. Both buyer and seller must provide PAN details to avoid higher tax deductions. The buyer must deposit the TDS with the government and issue Form 16B to the seller as proof.

TDS applies to residential and commercial properties but excludes agricultural land. This system ensures tax compliance and tracks high-value real estate transactions effectively.

Why is TDS Important in Property Transactions?

The primary objective of TDS on property sales is to prevent tax evasion and ensure timely tax collection on income generated from property transactions. By enforcing tax deduction at the time of sale, the system eliminates reliance on sellers to declare income and pay taxes at the end of the financial year. This approach enhances transparency, accountability, and compliance in real estate dealings.

The primary objective of TDS on property sales is to prevent tax evasion and ensure timely tax collection on income generated from property transactions. By enforcing tax deduction at the time of sale, the system eliminates reliance on sellers to declare income and pay taxes at the end of the financial year. This approach enhances transparency, accountability, and compliance in real estate dealings.

Explore Properties in Noida

- Apartments for Sale in Sector 107

- Apartments for Sale in Sector 121

- Apartments for Sale in Sector 128

- Apartments for Sale in Sector 72

- Apartments for Sale in Sector 150

- Apartments for Sale in Sector 76

- Apartments for Sale in Sector 73

- Apartments for Sale in Sector 52

- Apartments for Sale in Sector 51

- Apartments for Sale in Sector 143

- Builder Floors for Sale in Sector 107

- Builder Floors for Sale in Sector 104

- Builder Floors for Sale in Bhangel

- Builder Floors for Sale in Sector 72

- Builder Floors for Sale in Divine Meadows

- Builder Floors for Sale in Sector 108

- Builder Floors for Sale in Gadi Choukhandi

- Builder Floors for Sale in Sector 73

- Retail Shop for Sale in Phase II

- Retail Shop for Sale in Sector 129

- Retail Shop for Sale in Sector 94

- Retail Shop for Sale in Sector 98

- Retail Shop for Sale in Sector 140 A

- Retail Shop for Sale in Sector 50

Here are the key reasons why TDS is important:

🔹 Prevents tax evasion: TDS ensures that a portion of the sale amount is directly remitted to the government, reducing the risk of underreporting or concealing income from property sales.

🔹 Ensures timely tax collection: Instead of waiting until the end of the financial year, TDS enables immediate tax collection at the time of transaction, providing the government with a steady revenue stream.

🔹 Enhances transparency: By monitoring high-value property transactions, the government can track irregularities and prevent fraudulent activities, ensuring a transparent real estate market.

🔹 Reduces compliance burden: Since a part of the seller’s tax liability is pre-paid through TDS, it reduces the burden of making a large lump sum tax payment at year-end.

🔹 Strengthens tax compliance: TDS creates a direct link between property transactions and tax payments, discouraging individuals from underreporting taxable income.

🔹 Ease of verification: All TDS deductions are recorded online, making it easier for both taxpayers and authorities to verify transactions through the income tax portal.

By implementing TDS in property sales, the government ensures greater compliance and accountability, benefiting both buyers and sellers in the long run.

Applicability of TDS on Property Purchases

TDS is applicable when a buyer purchases immovable property (such as land or a building) from a resident Indian seller, provided the property value is ₹50 lakh or more. If the sale value is below this threshold, TDS does not apply.

Key Aspects of TDS Applicability

🔹 Property Value: TDS is deducted only if the sale price is ₹50 lakh or more.

🔹 Type of Property: Applies to immovable properties, including land, buildings, or portions of a building.

🔹 Seller’s Residency Status: TDS under this section is applicable only if the seller is a resident Indian. For Non-Resident Indians (NRIs), different TDS rules apply.

🔹 Exclusion of Agricultural Land: Purchases of agricultural land are not covered under this provision.

🔹 Implementation Date: Section 194-IA was introduced on June 1, 2013, making it mandatory to deduct TDS on property transactions exceeding ₹50 lakh.

Understanding Section 194-IA of the Income Tax Act

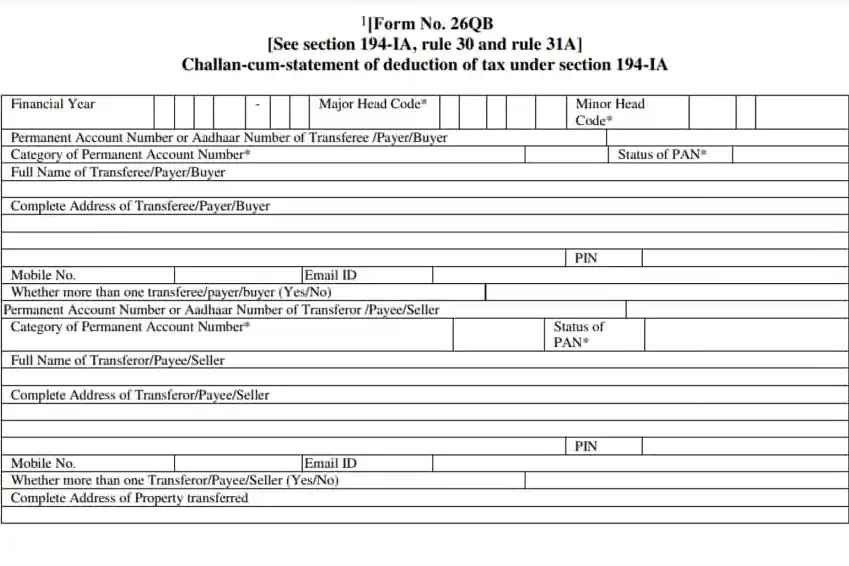

Image Source: Google.com

Section 194-IA of the Income Tax Act governs TDS on the sale of immovable property. It lays out the conditions, rates, and procedures for deducting and depositing TDS on such transactions to ensure tax compliance.

Key Provisions of Section 194-IA

🔹 TDS Deduction Obligation: The buyer is responsible for deducting TDS when purchasing immovable property valued at ₹50 lakh or more.

🔹 Applicable TDS Rate: The standard TDS rate is 1% of the total sale consideration for transactions with resident sellers. For Non-Resident Indians (NRIs), the rate is 20% (or lower if applicable under DTAA).

🔹 PAN Requirement: Both the buyer and seller must provide PAN details for the transaction to be processed.

🔹 No TAN Required: Unlike other TDS deductions, the buyer does not need a Tax Deduction Account Number (TAN) to deduct and deposit TDS.

🔹 TDS Payment & Form 26QB: The deducted TDS must be deposited with the Central Government using Form 26QB within 30 days from the end of the month in which the deduction was made.

🔹 Issuance of Form 16B: After the deposit, the buyer must download Form 16B from the TRACES website and provide it to the seller as proof of TDS deduction.

🔹 Additional Charges Included: The sale value for TDS calculation includes charges like club membership, parking fees, utilities, maintenance, and advance fees related to the property. This rule has been in effect since September 2019.

TDS Rates and Thresholds (2025)

As of 2025, the TDS rate on property sales in India continues to be 1% for individuals and Hindu Undivided Families (HUFs). However, understanding the applicable rates and thresholds is essential for ensuring proper compliance with tax regulations.

| Seller Type | TDS Rate | Threshold Limit |

|---|---|---|

| Resident Indian (Individual/HUF) | 1% of the transaction value | Applicable if the property value is ₹50 lakh or more |

| Companies and Other Entities | 2% of the transaction value | Applicable if the property value is ₹50 lakh or more |

| Non-Resident Indian (NRI) | As per Section 195, which can be higher (including surcharge and cess) depending on the income slab | Applicable if the property value is ₹50 lakh or more, subject to treaty benefits |

The table below outlines the applicable TDS rates for different recipient categories, based on whether they have a valid PAN or not. The rates were temporarily reduced between 14 May 2020 and 31 March 2021 as part of COVID-19 relief measures.

| Recipient Category | With PAN | Without PAN |

|---|---|---|

| Resident Individual or HUF | 1% (0.75% for 14 May 2020 to 31 March 2021) | 20% |

| Any Resident Person (other than Individual or HUF) | 2% (1.5% for 14 May 2020 to 31 March 2021) | 20% |

| Transporters | NIL (NIL for 14 May 2020 to 31 March 2021) | 20% |

TDS on Property Purchase Above ₹50 Lakhs

The ₹50 lakh threshold plays a crucial role in determining whether TDS applies to a property transaction. If the property value exceeds ₹50 lakh, the buyer is legally required to deduct and deposit TDS.

Key Points to Note:

🔹 TDS on Full Sale Value: If the property price is above ₹50 lakh, TDS is calculated on the entire sale amount, not just the excess. For example, for a ₹60 lakh property, TDS applies to ₹60 lakh, not just the extra ₹10 lakh.

🔹 Based on Stamp Duty Value: If the stamp duty value of the property is higher than the sale price, TDS must be deducted based on the stamp duty value. For instance, if a property is sold for ₹60 lakh but the stamp duty value is ₹65 lakh, TDS will be calculated on ₹65 lakh.

🔹 Additional Charges Included: The total sale value includes expenses like club membership fees, parking charges, utility charges, maintenance fees, or any advance payments associated with the property. This rule applies to properties purchased on or after September 2019.

If a property is sold for ₹50 lakhs or more, the buyer must:

🔹 Deduct 1% TDS (or 20% for NRI sellers). 🔹 Deposit the TDS using Challan 26QB. 🔹 Provide Form 16B to the seller.

Example: If you purchase a property for ₹80 lakhs, TDS = 1% of ₹80 lakhs = ₹80,000.

TDS for Resident and Non-Resident Sellers

The TDS rate and procedures differ based on whether the seller is a Resident Indian or a Non-Resident Indian (NRI).

For Resident Sellers:

🔹 TDS Rate: 1% of the total sale value.

🔹 Applicability: TDS is deducted only if the property price is ₹50 lakh or more.

🔹 Compliance: The buyer must deduct TDS and deposit it using Form 26QB within the prescribed time.

For Non-Resident Sellers (NRIs):

🔹 TDS Rate: Governed by Section 195, the rate is generally higher—around 20% (plus surcharge & cess) on long-term capital gains.

🔹 Applicability: TDS applies when the property value exceeds ₹50 lakh.

🔹 Compliance: The buyer must deduct TDS at the applicable rate and deposit it with the government. The NRI seller may need a tax certificate from the Income Tax Department to determine the correct TDS rate based on their income tax slab.

Calculation of TDS on Property Transactions

For Resident Sellers:

- TDS Rate: 1% of the property value if the sale price exceeds ₹50 lakh.

- No Additional Charges: Surcharge and cess do not apply.

Example: If you buy a property for ₹75 lakh from a resident seller, the TDS amount will be ₹75,000 (1% of ₹75 lakh).

For Non-Resident (NRI) Sellers:

- TDS Rate: 20% on the total sale amount.

- Additional Charges: Surcharge and cess apply, increasing the overall TDS liability.

- Tax Relief Option: NRIs can apply for a lower TDS certificate under Section 197 to reduce the deduction based on actual capital gains.

Example: If an NRI sells a property for ₹1 crore, the TDS deducted will be ₹20 lakh or more (including surcharge & cess, depending on tax slab and DTAA benefits).

Responsibilities of the Buyer and Seller

Buyer's Responsibilities:

🔹 Deduct TDS: The buyer must deduct TDS at the applicable rate from the total sale amount.

🔹 Use PAN for TDS Payment: While TAN is not mandatory, the buyer can use their PAN to deposit the TDS.

🔹 Deposit TDS on Time: The deducted TDS must be deposited with the government within seven days from the end of the month in which it was deducted.

🔹 Issue Form 16B: The buyer should provide Form 16B to the seller as proof of TDS deduction.

🔹 File TDS Returns: Buyers must file TDS returns with details of the amount deducted and deposited.

Seller's Responsibilities:

🔹 Provide PAN: The seller must share their PAN with the buyer to avoid a higher TDS rate (20%).

🔹 Verify TDS Deposit: The seller should check Form 26AS to ensure that the TDS has been correctly deposited by the buyer.

🔹 Collect Form 16B: The seller must obtain Form 16B from the buyer as proof of TDS deduction.

🔹 Report in Tax Return: The seller needs to declare the property sale income in their tax return and claim credit for the deducted TDS.

TDS Deduction in Installment-Based Payments

When purchasing a property through installments, TDS must be deducted on each payment instead of waiting until the full amount is paid. This method ensures that tax is collected consistently over the payment period.

Key Considerations:

🔹 Deduct TDS on Every Installment: Each time an installment is paid, the buyer must deduct TDS before transferring the amount to the seller.

🔹 Calculate TDS Proportionally: TDS should be calculated separately for each installment based on the applicable rate.

🔹 Meet Filing Deadlines: The deducted TDS must be deposited with the government and reported within the prescribed time for each installment.

Filing TDS: The Procedure and Forms

Filing TDS on property purchases follows a structured process involving specific forms and steps. Below is an overview:

🔹 TAN (Tax Deduction and Collection Account Number): Though not mandatory, buyers are encouraged to obtain a TAN for TDS-related transactions. However, they can also use their PAN instead.

🔹 Fill Form 26QB: This form is used to report TDS on property transactions and requires details of the buyer, seller, property, and deducted TDS amount.

🔹 Deposit the TDS: The deducted TDS must be paid to the government via authorized banks or through an online payment portal.

🔹 Generate and Issue Form 16B: Once the TDS is deposited, the buyer must download Form 16B from the Income Tax Department's TRACES portal and provide it to the seller as proof of deduction.

How to File 26QB TDS Return Online?

Image Source: Google.com

Form 26QB is a challan-cum-statement used for paying TDS on property transactions. Follow these steps to file it online:

Step 1: Visit the Official Tax Payment Portal

🔹 Go to the TIN-NSDL website for e-payment of taxes.

Step 2: Select Form 26QB

🔹 Click on TDS on Sale of Property to open the Form 26QB filing section.

🔹Generate and Print Form 26QB

Step 3: Enter Required Details

-

Buyer & Seller Information

🔹Enter the PAN, name, address, and contact details of both parties. -

Property Details

🔹Provide the property address, date of sale agreement, and total sale value. -

TDS Deduction Details

🔹Mention the TDS amount deducted and the date of deduction. -

Payment Details

🔹Select your preferred payment method (Net Banking, Debit/Credit Card) and complete the payment.

Step 4: Download the Challan

🔹After successful payment, download the challan for Form 26QB.

🔹This serves as proof that TDS has been paid.

Once done, the buyer can proceed to generate and download Form 16B as proof of TDS deduction.

Notice for Non-Filing of Form 26QB

The Income Tax Department regularly receives an Annual Information Return (AIR) from the Registrar/Sub-Registrar's office regarding property transactions. Based on this report, the department can identify if an individual has purchased a property valued at ₹50 lakh or more.

If the buyer fails to deduct TDS at 1% of the purchase amount or does not file Form 26QB within the prescribed time, the Income Tax Department may issue a notice to the buyer.

Sample Notice Sent to the Taxpayer

Subject: CPC (TDS) - Follow-Up on Non-Filing of Form 26QB for Property Purchase in FY 2023-24

Date of Notice: 05/04/2026

Dear Property Buyer,

PAN: XXXXX1234X

As per records from the Registrar/Sub-Registrar’s office, you have completed a property purchase transaction exceeding ₹50 lakh during the Financial Year 2023-24.

However, we have not yet received your TDS Statement (Form 26QB) for this transaction.

Your immediate attention is required to:

- File Form 26QB for reporting TDS on the property purchase.

- Download and issue Form 16B (TDS Certificate) to the seller via the TRACES portal.

Failure to comply may result in penalties and interest as per Income Tax regulations.

How to Mention TDS in the Sale Deed?

To ensure clarity and compliance, the sale deed must explicitly mention TDS deductions. It should include the following details:

-

Total Sale Consideration

🔹 The final agreed sale price of the property. -

TDS Deducted

🔹 The exact amount of TDS that the buyer has deducted from the total sale value. -

PAN Information

🔹 The PAN details of both the buyer and the seller. -

TDS Deduction Confirmation

🔹 A statement confirming that the buyer has deducted TDS as per Section 194-IA of the Income Tax Act. -

Challan Payment Details

🔹 TDS payment proof, including the challan number, payment date, and deducted amount.

Adding these details helps maintain transparency and avoids future legal or tax-related disputes.

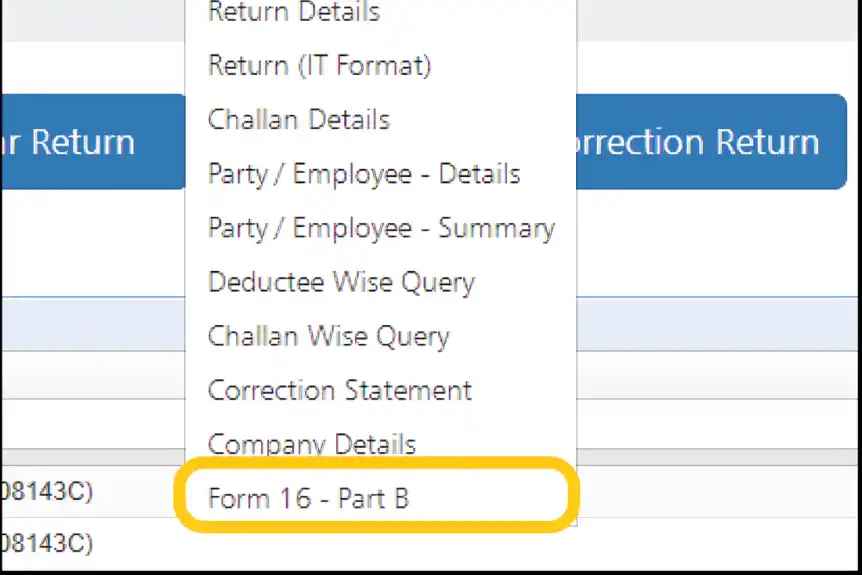

Steps to Download Form 16B from TRACES

Image Source: Google.com

Form 16B is a TDS certificate that the buyer must provide to the seller as proof of TDS deduction. Follow these steps to download it from the TRACES portal:

1. Register on TRACES

🔹 The buyer must first register on the TRACES website as a taxpayer using their PAN.

2. Log in to TRACES

🔹 Use the registered credentials to access the TRACES portal.

3. Go to the Downloads Section

🔹 Click on the "Downloads" menu and select "Form 16B" from the available options.

4. Enter Assessment Year and Seller’s PAN

🔹 Provide the correct assessment year and the seller’s PAN details to proceed.

5. Download Form 16B

🔹 Submit the required details and download the certificate. The buyer must then share Form 16B with the seller as proof of TDS deduction.

Consequences of Non-Deduction or Non-Deposit of TDS

For the Buyer of the Property

🔹 If Form 26QB is not filed or filed late, a fee under Section 234E of the Income Tax Act will be charged.

🔹 The buyer must pay ₹200 per day for every day the filing is delayed.

🔹 Additionally, the buyer may face penalties for late deduction, late payment, and applicable interest charges.

🔹 The Assessing Officer may impose a penalty under Section 271H for non-compliance.

For the Seller of the Property

🔹 If Form 26QB is not filed or delayed, the seller will not be able to claim TDS credit on the transaction.

🔹 The deducted TDS must be deposited with the government through net banking or authorized bank branches.

🔹 As per Section 194-IA, the TDS must be paid within seven days from the end of the month in which it was deducted.

Penalties for Late Filing or Non-Payment of TDS

| Penalty Type | Calculation |

|---|---|

| Not deducting TDS | 1% per month from the date on which TDS was supposed to be deducted until the actual deduction date. |

| Not depositing the TDS with the government | 1.5% per month from the date TDS was deducted until it is deposited with the government. |

| Late Filing Fee | Calculation |

|---|---|

| Late filing fee under Section 234E @ ₹200 per day | If Form 26QB is not submitted on time, a fine of ₹200 per day applies until submission. This is in addition to the interest charges above. |

Explore Properties in Noida

- Apartments for Sale in Sector 107

- Apartments for Sale in Sector 121

- Apartments for Sale in Sector 128

- Apartments for Sale in Sector 72

- Apartments for Sale in Sector 150

- Apartments for Sale in Sector 76

- Apartments for Sale in Sector 73

- Apartments for Sale in Sector 52

- Apartments for Sale in Sector 51

- Apartments for Sale in Sector 143

- Builder Floors for Sale in Sector 107

- Builder Floors for Sale in Sector 104

- Builder Floors for Sale in Bhangel

- Builder Floors for Sale in Sector 72

- Builder Floors for Sale in Divine Meadows

- Builder Floors for Sale in Sector 108

- Builder Floors for Sale in Gadi Choukhandi

- Builder Floors for Sale in Sector 73

- Retail Shop for Sale in Phase II

- Retail Shop for Sale in Sector 129

- Retail Shop for Sale in Sector 94

- Retail Shop for Sale in Sector 98

- Retail Shop for Sale in Sector 140 A

- Retail Shop for Sale in Sector 50

FAQs

1. What is TDS on the sale of property?

TDS (Tax Deducted at Source) is a portion of the sale amount deducted by the buyer and deposited with the government as advance tax on behalf of the seller. It applies to property transactions where the sale value is ₹50 lakhs or more.

2. What is the TDS rate on property sales?

For Resident Indians: 1% of the total sale consideration.

For Non-Resident Indians (NRIs): 20% (plus surcharge & cess) under Section 195 of the Income Tax Act.

3. Who is responsible for deducting and depositing TDS?

The buyer of the property must deduct TDS before making the payment to the seller and deposit it with the government.

4. How do I deposit TDS on a property purchase?

TDS can be deposited online through the TIN-NSDL website using Form 26QB. Payment can be made via net banking, debit card, or credit card.

5. What is Form 26QB?

Form 26QB is the challan-cum-statement used to deposit TDS on property sales. It includes details of the buyer, seller, property, and TDS amount.

6. What is Form 16B and how do I obtain it?

Form 16B is the TDS certificate that the buyer issues to the seller as proof of TDS deduction. The buyer can download it from the TRACES portal after depositing the TDS.

7. What is the time limit for depositing TDS?

TDS must be deposited within 7 days from the end of the month in which the deduction was made.

8. What happens if I fail to deduct or deposit TDS on time?

Interest: 1% per month for late deduction, 1.5% per month for late payment.

Penalty: ₹200 per day for late filing of Form 26QB under Section 234E.

Additional penalties may be imposed under Section 271H.

9. How can the seller verify if TDS has been deposited correctly?

The seller can verify the TDS deposit by checking their Form 26AS (Annual Tax Statement) online.

10. Can the seller claim a refund of the TDS amount?

Yes, if the seller’s total tax liability is less than the TDS deducted, they can claim a refund when filing their income tax return.

India's Best Real Estate Housing App

Scan to Download the app

Explore Properties for Sale in noida:

- Apartments for Sale in Sector 107 Noida

- Apartments for Sale in Sector 121 Noida

- Apartments for Sale in Sector 128 Noida

- Apartments for Sale in Sector 72 Noida

- Apartments for Sale in Sector 150 Noida

- Apartments for Sale in Sector 76 Noida

- Apartments for Sale in Sector 73 Noida

- Apartments for Sale in Sector 52 Noida

- Apartments for Sale in Sector 51 Noida

- Apartments for Sale in Sector 143 Noida

- Builder Floors for Sale in Sector 107 Noida

- Builder Floors for Sale in Sector 104 Noida

- Builder Floors for Sale in Bhangel Noida

- Builder Floors for Sale in Sector 72 Noida

- Builder Floors for Sale in Divine Meadows Noida

- Builder Floors for Sale in Sector 108 Noida

- Builder Floors for Sale in Gadi Choukhandi Noida

- Builder Floors for Sale in Sector 73 Noida

- Retail Shop for Sale in Phase II Noida

- Retail Shop for Sale in Sector 129 Noida

- Retail Shop for Sale in Sector 94 Noida

- Retail Shop for Sale in Sector 98 Noida

- Retail Shop for Sale in Sector 140 A Noida

- Retail Shop for Sale in Sector 50 Noida

- Retail Shop for Sale in Sector 105 Noida

- Retail Shop for Sale in Sector 110 Noida

- Office Space for Sale in Sector 140 A Noida

- Office Space for Sale in Sector 129 Noida

- Office Space for Sale in Sector 142 Noida

- Showroom for Sale in Sector 98 Noida

- Showroom for Sale in Sector 129 Noida

- Warehouse for Sale in Sector 82 Noida

Explore Properties for Rent in noida:

- Apartments for Rent in Sector 75 Noida

- Apartments for Rent in Sector 137 Noida

- Apartments for Rent in Chhaprauli Bangar Noida

- Apartments for Rent in Noida Extension Noida

- Apartments for Rent in Sector 78 Noida

- Apartments for Rent in Sector 63 Noida

- Apartments for Rent in Sector 74 Noida

- Apartments for Rent in Sector 70 Noida

- Apartments for Rent in Sector 142 Noida

- Apartments for Rent in Sector 48 Noida

- Villa for Rent in Rwa Noida

- Villa for Rent in Sadarpur Noida

- Villa for Rent in Sector 41 Noida

- Villa for Rent in Sector 19 Noida

- Office Space for Rent in Bajidpur Noida

- Office Space for Rent in Sector 142 Noida

- Office Space for Rent in Sector 144 Noida

- House for Rent in Sector 19 Noida

- House for Rent in Sector 142 Noida

- House for Rent in Sector 67 Noida

- Builder Floors for Rent in Sector 122 Noida

- Builder Floors for Rent in Bhangel Noida

- Builder Floors for Rent in Sector 142 Noida

- Retail Shop for Rent in Sector 78 Noida

- Retail Shop for Rent in Sector 106 Noida

- 1 Rk Studio for Rent in Sector 70 Noida

- 1 Rk Studio for Rent in Sector 51 Noida

Explore Plots for sale in noida:

- Plot for Sale Sector 4 Noida

- Plot for Sale Kulesara Noida

- Plot for Sale Phase II Noida

- Plot for Sale Samastpur Noida

- Plot for Sale Sector 16a Noida

- Plot for Sale Sector 17 Noida

- Plot for Sale Sector 128 Noida

- Plot for Sale Bhangel Noida

- Plot for Sale Sector 2 Noida

- Plot for Sale Sector 142 Noida

- Commercial Plot for Sale in Sector 92 Noida

Explore PG’s for Rent in noida:

- PG’s for Rent in Sector 19 Noida

- PG’s for Rent in Sector 15 Noida

- PG’s for Rent in Sector 71 Noida

- PG’s for Rent in Sector 62 Noida

- PG’s for Rent in Sector 137 Noida

- PG’s for Rent in Sector 72 Noida

- PG’s for Rent in Sector 92 Noida

- PG’s for Rent in Sector 27 Noida

- PG’s for Rent in Sector 49 Noida

- PG’s for Rent in Sector 18 Noida

Explore Co-living options in noida:

- Sharing Room/Flats in Sector 75 Noida

- Sharing Room/Flats in Sector 74 Noida

- Sharing Room/Flats in Sector 76 Noida

- Sharing Room/Flats in Sector 70 Noida

- Sharing Room/Flats in Sector 137 Noida

- Sharing Room/Flats in Sector 77 Noida

- Sharing Room/Flats in Sector 51 Noida

- Sharing Room/Flats in Sector 52 Noida

- Sharing Room/Flats in Sector 55 Noida

- Sharing Room/Flats in Sector 134 Noida

- Sharing Room/Flats in Sector 117 Noida

- Sharing Room/Flats in Sector 63 Noida

- Sharing Room/Flats in Sector 92 Noida

Buy, Sell & Rent Properties – Download HexaHome App Now!

Find your perfect home, PG, or rental in just a few clicks.

Post your property at ₹0 cost and get genuine buyers & tenants fast

Smart alerts & search helps you find homes that fit your budget.

Available on iOS & Android

A Product By Hexadecimal Software Pvt. Ltd.