Triple Net Leases: A Guide for Real Estate Investment

Updated on : 21 April 2025

Image Source: google.com

What is a Triple Net (NNN) Lease?

A Triple Net (NNN) Lease is a commercial lease where the tenant pays rent plus three major expenses: property taxes, insurance, and maintenance. This structure provides landlords with steady, low-risk income, as tenants handle most of the property's operational costs.

Image Source: LinkedIn.com

🏡 Don't miss out! Find your commercial property on HexaHome!

How Triple Net Leases Work

In a Triple Net Lease, tenants pay rent along with property expenses like taxes, insurance, and maintenance, reducing the landlord's financial responsibilities.

| Tenant Responsibilities | Landlord Responsibilities |

|---|---|

| Property Taxes | Receive rent payment |

| Insurance Costs | Minimal involvement in property management |

| Maintenance and Repairs | Ensure property meets safety standards |

| Utilities (if specified) | Occasionally handle major property repairs |

Key Components of NNN Leases

Triple Net Leases consist of key elements like rent, property taxes, insurance, and maintenance costs, which tenants are responsible for, ensuring steady landlord income.

| Component | Description |

|---|---|

| Base Rent | The fixed monthly rent paid by the tenant |

| Property Taxes | Tenant covers the property tax expenses |

| Insurance | Tenant is responsible for building insurance |

| Maintenance | Tenant pays for repairs and maintenance |

| Utilities | Tenant pays for utilities (if applicable) |

| Common Area Expenses | Tenant pays for shared spaces (if applicable) |

You Might Also Like

Types of Properties Suitable for NNN Leases

NNN leases are ideal for stable, income-generating properties like retail spaces, standalone buildings, and long-term commercial establishments, where tenants are reliable.

| Property Type | Description |

|---|---|

| Retail Spaces | Common in strip malls, standalone stores, and franchises |

| Standalone Buildings | Freestanding buildings like fast food chains or pharmacies |

| Office Buildings | Long-term corporate tenants with minimal property needs |

| Industrial Properties | Warehouses and distribution centers |

| Medical Offices | Healthcare facilities with stable tenant requirements |

🏡 Don't miss out! Find your commercial property on HexaHome!

Pros and Cons of Triple Net Leases

NNN leases offer benefits like stable income for landlords, but also come with risks, as tenants assume most property-related expenses, which can affect profitability.

Explore Properties in Noida

- Apartments for Sale in Sector 107

- Apartments for Sale in Sector 121

- Apartments for Sale in Sector 128

- Apartments for Sale in Sector 72

- Apartments for Sale in Sector 150

- Apartments for Sale in Sector 76

- Apartments for Sale in Sector 73

- Apartments for Sale in Sector 52

- Apartments for Sale in Sector 51

- Apartments for Sale in Sector 143

- Builder Floors for Sale in Sector 107

- Builder Floors for Sale in Sector 104

- Builder Floors for Sale in Bhangel

- Builder Floors for Sale in Sector 72

- Builder Floors for Sale in Divine Meadows

- Builder Floors for Sale in Sector 108

- Builder Floors for Sale in Gadi Choukhandi

- Builder Floors for Sale in Sector 73

- Retail Shop for Sale in Phase II

- Retail Shop for Sale in Sector 129

- Retail Shop for Sale in Sector 94

- Retail Shop for Sale in Sector 98

- Retail Shop for Sale in Sector 140 A

- Retail Shop for Sale in Sector 50

| Pros | Cons |

|---|---|

| Steady, predictable income | Landlord may face property value fluctuations |

| Reduced landlord responsibility | Tenants may neglect property upkeep |

| Long-term, stable leases | Higher vacancy risks if tenant leaves |

| Attractive to investors | May not suit properties with high maintenance needs |

| Lower management costs | Limited control over tenant's operations |

Image Source: facebook.com

Looking for Rent in India? 🏡✨ Find your perfect rental on HexaHome! 🔑

Triple Net Lease vs. Other Lease Types

Triple Net Leases differ from other lease types in terms of tenant responsibilities and landlord involvement, providing a more hands-off investment option.

| Lease Type | Tenant Responsibilities | Landlord Responsibilities |

|---|---|---|

| Triple Net (NNN) | Pays rent, taxes, insurance, and maintenance | Receives rent, minimal involvement |

| Gross Lease | Pays only rent | Covers taxes, insurance, and maintenance |

| Modified Gross Lease | Pays rent plus part of operating expenses | Covers remaining expenses like taxes and insurance |

| Percentage Lease | Pays rent plus a percentage of sales | Receives rent and a share of sales profits |

Looking for Real Estate Projects in India? 🏗️✨ Explore top-rated projects on HexaHome!🔑🏠

Investor Benefits: Why Choose an NNN Lease?

NNN leases offer investors steady, low-risk income, reduced property management duties, and long-term financial stability, making them an attractive option.

| Benefit | Description |

|---|---|

| Stable, Predictable Income | Steady rent payments from reliable tenants |

| Low Management Involvement | Tenant handles most property-related expenses |

| Long-Term Contracts | Leases typically last 10-25 years with options to renew |

| Attractive to Investors | Ideal for those seeking passive income with low risk |

| Minimal Property Maintenance | Less responsibility for repairs and upkeep |

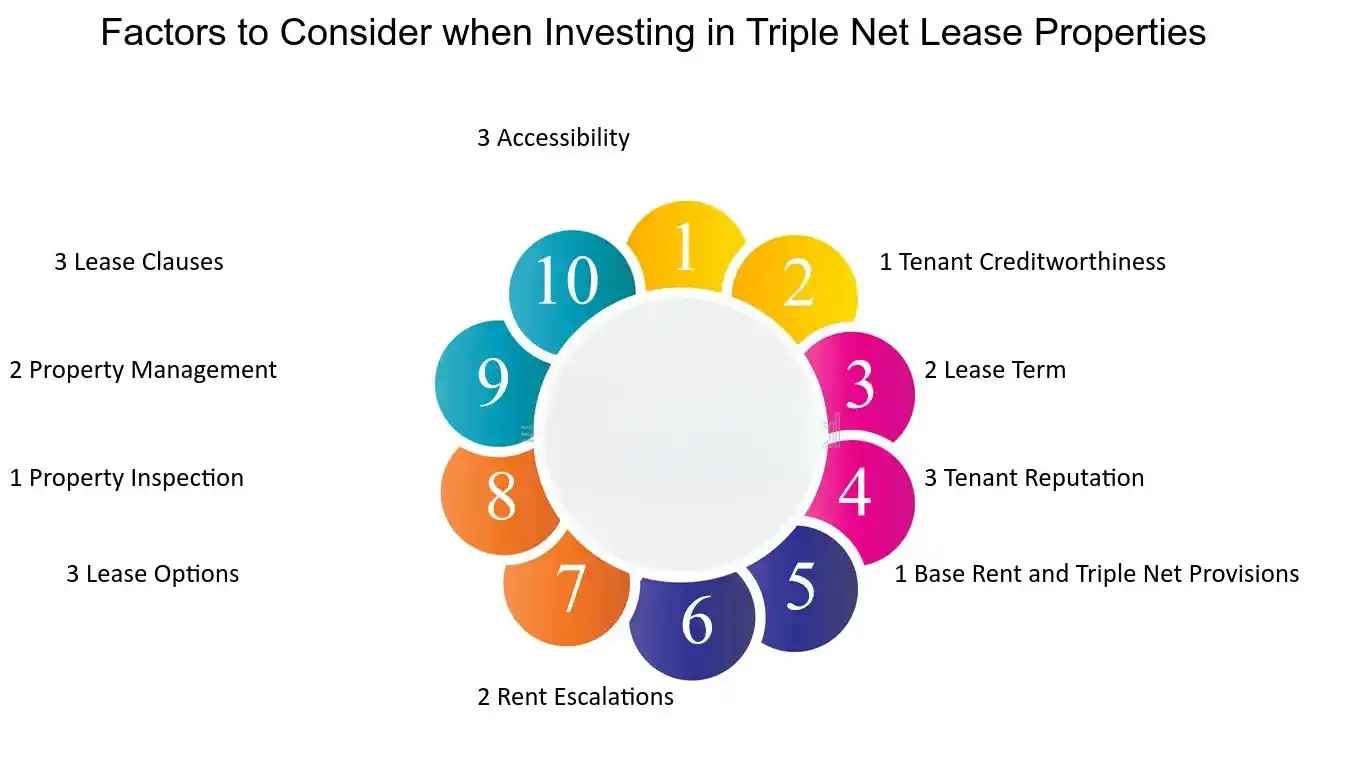

Risks and Challenges to Consider

While NNN leases offer benefits, they come with risks such as tenant reliability, potential vacancies, and unforeseen maintenance issues that investors must consider.

| Risk/Challenge | Description |

|---|---|

| Tenant Default | Risk of tenants failing to meet their financial obligations |

| Property Maintenance | Tenants may neglect upkeep, leading to additional costs |

| Vacancy Risk | If tenant leaves, the property may remain vacant for extended periods |

| Market Fluctuations | Property value and rent levels can fluctuate based on the market |

| Limited Control | Landlords have minimal control over tenant's use of the property |

Image Source: google.com

Looking for Plots in India? 🏡✨ Find your perfect plot on HexaHome! 🔑🏠

Tips for Negotiating a Triple Net Lease

Negotiating a Triple Net Lease requires careful attention to terms like rent, responsibilities, and contingencies to ensure a balanced deal that benefits both landlord and tenant.

| Tip | Description |

|---|---|

| Understand Costs | Clarify which expenses the tenant is responsible for, including taxes, insurance, and maintenance |

| Negotiate Rent | Ensure the base rent is fair and competitive for the market |

| Set Clear Maintenance Guidelines | Define tenant responsibilities for maintenance and repair tasks |

| Include Escalation Clauses | Include rent increases over time to account for inflation and rising costs |

| Consider Lease Duration | Negotiate a lease term that provides stability but is flexible enough for future changes |

Looking for PG in India? 🛏️✨ Find your perfect PG on HexaHome! 🔑🏠

Is a Triple Net Lease Right for You?

A Triple Net Lease can be a great option for investors seeking stable income with minimal management, but it's important to weigh the benefits against potential risks and responsibilities.

| Consideration | Description |

|---|---|

| Investment Goals | If you're seeking low-maintenance, long-term income, NNN leases may be ideal |

| Tenant Reliability | Ensure the tenant is financially stable and capable of handling lease responsibilities |

| Property Type | NNN leases work best with stable, income-generating properties like retail or office buildings |

| Risk Tolerance | If you're comfortable with potential risks like vacancies and market fluctuations, NNN leases are a solid choice |

| Management Involvement | NNN leases require minimal management, making them a good fit for passive investors |

Explore Properties in Noida

- Apartments for Sale in Sector 107

- Apartments for Sale in Sector 121

- Apartments for Sale in Sector 128

- Apartments for Sale in Sector 72

- Apartments for Sale in Sector 150

- Apartments for Sale in Sector 76

- Apartments for Sale in Sector 73

- Apartments for Sale in Sector 52

- Apartments for Sale in Sector 51

- Apartments for Sale in Sector 143

- Builder Floors for Sale in Sector 107

- Builder Floors for Sale in Sector 104

- Builder Floors for Sale in Bhangel

- Builder Floors for Sale in Sector 72

- Builder Floors for Sale in Divine Meadows

- Builder Floors for Sale in Sector 108

- Builder Floors for Sale in Gadi Choukhandi

- Builder Floors for Sale in Sector 73

- Retail Shop for Sale in Phase II

- Retail Shop for Sale in Sector 129

- Retail Shop for Sale in Sector 94

- Retail Shop for Sale in Sector 98

- Retail Shop for Sale in Sector 140 A

- Retail Shop for Sale in Sector 50

FAQs

Que: What is a Triple Net Lease?

Ans: A lease where tenants pay rent, taxes, insurance, and maintenance costs, reducing landlord responsibilities.

Que: How is a Triple Net Lease different from a Gross Lease?

Ans: In a Gross Lease, the landlord covers expenses, while in NNN, the tenant pays them.

Que: What properties suit Triple Net Leases?

Ans: Retail spaces, standalone buildings, office properties, and long-term commercial leases.

Que: What are the benefits of Triple Net Leases?

Ans: Stable income, low management, and long-term contracts make them attractive to investors.

Que: What risks are involved in Triple Net Leases?

Ans: Risks include tenant default, maintenance issues, vacancies, and market fluctuations.

Que: Can Triple Net Leases be negotiated?

Ans: Yes, rent, responsibilities, and lease terms can be negotiated for fairness.

India's Best Real Estate Housing App

Scan to Download the app

Explore Properties for Sale in noida:

- Apartments for Sale in Sector 107 Noida

- Apartments for Sale in Sector 121 Noida

- Apartments for Sale in Sector 128 Noida

- Apartments for Sale in Sector 72 Noida

- Apartments for Sale in Sector 150 Noida

- Apartments for Sale in Sector 76 Noida

- Apartments for Sale in Sector 73 Noida

- Apartments for Sale in Sector 52 Noida

- Apartments for Sale in Sector 51 Noida

- Apartments for Sale in Sector 143 Noida

- Builder Floors for Sale in Sector 107 Noida

- Builder Floors for Sale in Sector 104 Noida

- Builder Floors for Sale in Bhangel Noida

- Builder Floors for Sale in Sector 72 Noida

- Builder Floors for Sale in Divine Meadows Noida

- Builder Floors for Sale in Sector 108 Noida

- Builder Floors for Sale in Gadi Choukhandi Noida

- Builder Floors for Sale in Sector 73 Noida

- Retail Shop for Sale in Phase II Noida

- Retail Shop for Sale in Sector 129 Noida

- Retail Shop for Sale in Sector 94 Noida

- Retail Shop for Sale in Sector 98 Noida

- Retail Shop for Sale in Sector 140 A Noida

- Retail Shop for Sale in Sector 50 Noida

- Retail Shop for Sale in Sector 105 Noida

- Retail Shop for Sale in Sector 110 Noida

- Office Space for Sale in Sector 140 A Noida

- Office Space for Sale in Sector 129 Noida

- Office Space for Sale in Sector 142 Noida

- Showroom for Sale in Sector 98 Noida

- Showroom for Sale in Sector 129 Noida

- Warehouse for Sale in Sector 82 Noida

Explore Properties for Rent in noida:

- Apartments for Rent in Sector 75 Noida

- Apartments for Rent in Sector 137 Noida

- Apartments for Rent in Chhaprauli Bangar Noida

- Apartments for Rent in Noida Extension Noida

- Apartments for Rent in Sector 78 Noida

- Apartments for Rent in Sector 63 Noida

- Apartments for Rent in Sector 74 Noida

- Apartments for Rent in Sector 70 Noida

- Apartments for Rent in Sector 142 Noida

- Apartments for Rent in Sector 48 Noida

- Villa for Rent in Rwa Noida

- Villa for Rent in Sadarpur Noida

- Villa for Rent in Sector 41 Noida

- Villa for Rent in Sector 19 Noida

- Office Space for Rent in Bajidpur Noida

- Office Space for Rent in Sector 142 Noida

- Office Space for Rent in Sector 144 Noida

- House for Rent in Sector 19 Noida

- House for Rent in Sector 142 Noida

- House for Rent in Sector 67 Noida

- Builder Floors for Rent in Sector 122 Noida

- Builder Floors for Rent in Bhangel Noida

- Builder Floors for Rent in Sector 142 Noida

- Retail Shop for Rent in Sector 78 Noida

- Retail Shop for Rent in Sector 106 Noida

- 1 Rk Studio for Rent in Sector 70 Noida

- 1 Rk Studio for Rent in Sector 51 Noida

Explore Plots for sale in noida:

- Plot for Sale Sector 4 Noida

- Plot for Sale Kulesara Noida

- Plot for Sale Phase II Noida

- Plot for Sale Samastpur Noida

- Plot for Sale Sector 16a Noida

- Plot for Sale Sector 17 Noida

- Plot for Sale Sector 128 Noida

- Plot for Sale Bhangel Noida

- Plot for Sale Sector 2 Noida

- Plot for Sale Sector 142 Noida

- Commercial Plot for Sale in Sector 92 Noida

Explore PG’s for Rent in noida:

- PG’s for Rent in Sector 19 Noida

- PG’s for Rent in Sector 15 Noida

- PG’s for Rent in Sector 71 Noida

- PG’s for Rent in Sector 62 Noida

- PG’s for Rent in Sector 137 Noida

- PG’s for Rent in Sector 72 Noida

- PG’s for Rent in Sector 92 Noida

- PG’s for Rent in Sector 27 Noida

- PG’s for Rent in Sector 49 Noida

- PG’s for Rent in Sector 18 Noida

Explore Co-living options in noida:

- Sharing Room/Flats in Sector 75 Noida

- Sharing Room/Flats in Sector 74 Noida

- Sharing Room/Flats in Sector 76 Noida

- Sharing Room/Flats in Sector 70 Noida

- Sharing Room/Flats in Sector 137 Noida

- Sharing Room/Flats in Sector 77 Noida

- Sharing Room/Flats in Sector 51 Noida

- Sharing Room/Flats in Sector 52 Noida

- Sharing Room/Flats in Sector 55 Noida

- Sharing Room/Flats in Sector 134 Noida

- Sharing Room/Flats in Sector 117 Noida

- Sharing Room/Flats in Sector 63 Noida

- Sharing Room/Flats in Sector 92 Noida

Buy, Sell & Rent Properties – Download HexaHome App Now!

Find your perfect home, PG, or rental in just a few clicks.

Post your property at ₹0 cost and get genuine buyers & tenants fast

Smart alerts & search helps you find homes that fit your budget.

Available on iOS & Android

A Product By Hexadecimal Software Pvt. Ltd.