What is a CIBIL Score?

Updated on : 19 June 2025

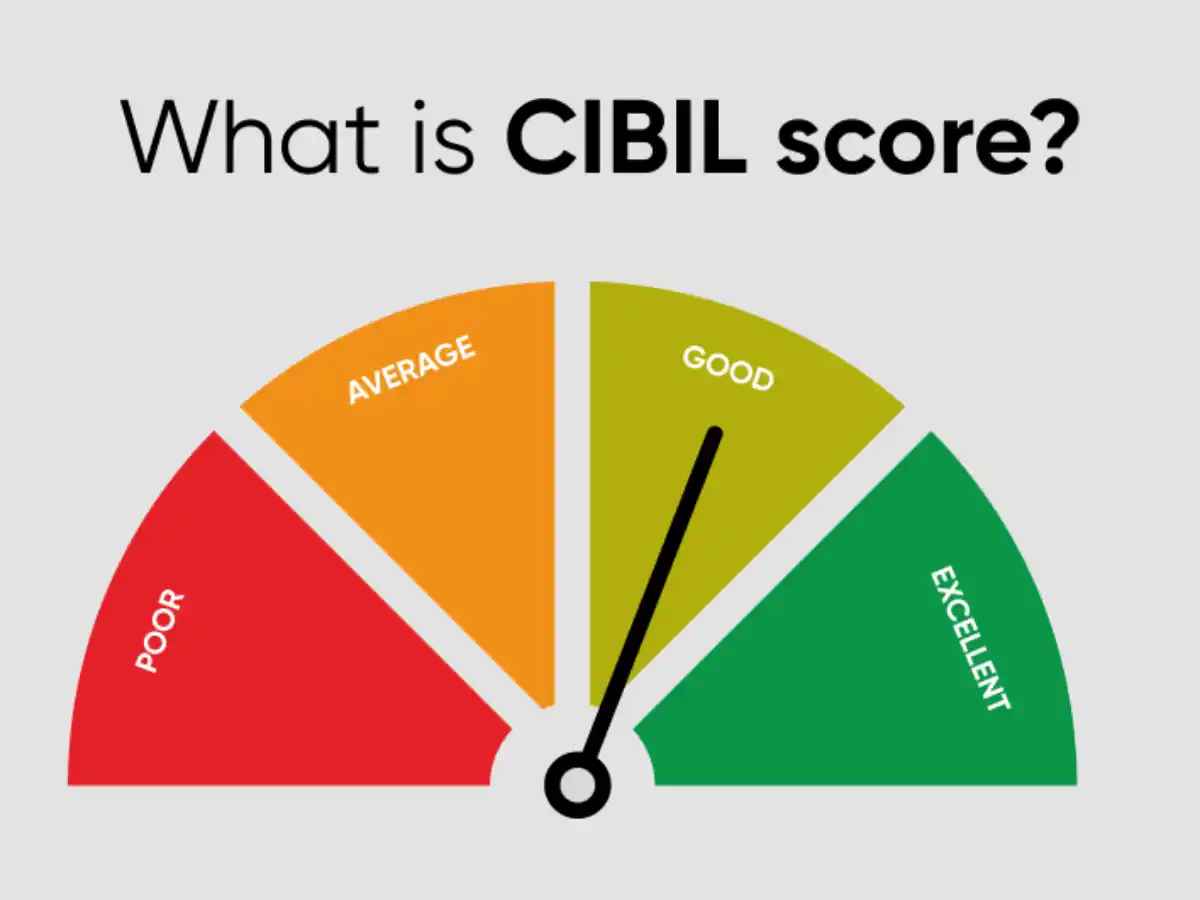

What is a CIBIL Score?

A CIBIL score is a three-digit number (300–900) representing your creditworthiness. It is issued by the Credit Information Bureau (India) Limited (CIBIL), which is licensed by the Reserve Bank of India (RBI). The score reflects your credit history — including loan repayments, defaults, and inquiries.

Your score can directly affect home loan approvals. Explore Noida real estate projects where your credit matters.

Why is a CIBIL Score Important?

Your score affects:

- Loan approvals and limits

- Interest rates (higher score = better rates)

- Decisions by landlords, employers, and insurers

It is reviewed by banks registered with the RBI and regulated under Credit Information Companies (Regulation) Act, 2005 (CICRA).

Legal Framework of Credit Scoring

| Requirement | Description |

|---|---|

| Data Accuracy | CIBIL follows strict protocols under CICRA for data accuracy. |

| Consumer Rights | Right to access and dispute your report under CICRA, 2005. |

| Compliance | Adheres to RBI and CICRA guidelines. |

| Security | Credit reports are protected under the Information Technology Act, 2000. |

CIBIL Score Calculation

| Factor | Weightage | Description |

|---|---|---|

| Payment History | 35% | Timely payments build trust and improve score. |

| Credit Utilization | 30% | Keep credit usage under 30% of your limit. |

| Credit History Length | 15% | Longer history = better reliability. |

| Credit Mix | 10% | Mix of secured and unsecured loans is preferred. |

| New Inquiries | 10% | Multiple inquiries may hurt your score. |

CIBIL Score Ranges

| Score Range | Meaning |

|---|---|

| 300–549 | Very high risk — difficult to get credit. |

| 550–649 | High risk — limited credit options. |

| 650–749 | Moderate risk — standard terms. |

| 750–849 | Low risk — better interest rates. |

| 850–900 | Excellent — best loan terms and offers. |

How to Check Your CIBIL Score

| Method | Details |

|---|---|

| CIBIL Website | One free report annually from cibil.com/freecibilscore. |

| RBI Mandate | RBI mandates one free report/year from each bureau. Read the official circular. |

| Apps | Financial apps like Bajaj Finserv provide free score checks. |

How to Improve Your CIBIL Score

| Tip | Details |

|---|---|

| Timely Payments | Never miss EMIs or credit card dues. |

| Low Credit Utilization | Try to use less than 30% of credit limit. |

| Avoid Multiple Loans | Too many inquiries affect your score. |

| Monitor Credit Report | Dispute errors on cibil.com dispute. |

| Credit Mix | Maintain both secured (home/car loans) and unsecured credit (cards). |

Tips for Maintaining a Healthy Score

| Practice | Action |

|---|---|

| Auto Pay Setup | Set auto-debit for EMIs and credit cards. |

| Review Limits | Request credit limit enhancement to lower usage %. |

| Dispute Quickly | Use CIBIL’s portal for rectifications. |

| Build Credit | Use secured credit cards to start if you’re new. |

| Stay Updated | Follow Ministry of Finance for credit policies. |

🏠 Want to buy a home in Noida? Check credit-friendly Noida properties curated by HexaHome.

FAQs

Que: What is a CIBIL score?

Ans: A 3-digit number between 300–900 reflecting your credit history and repayment behavior.

Que: What is a good score for loans?

Ans: 750+ is considered good for loan approvals and best interest rates.

Que: Where can I check my CIBIL score officially?

Ans: Visit CIBIL for one free score/year or visit RBI.

Que: Can I dispute an error in my report?

Ans: Yes, visit the CIBIL dispute portal.

Que: Is my data protected?

Ans: Yes, under the IT Act, 2000 and RBI compliance.

India's Best Real Estate Housing App

Scan to Download the app

Explore Properties for Sale in noida:

- Apartments for Sale in Sector 107 Noida

- Apartments for Sale in Sector 121 Noida

- Apartments for Sale in Sector 128 Noida

- Apartments for Sale in Sector 72 Noida

- Apartments for Sale in Sector 150 Noida

- Apartments for Sale in Sector 76 Noida

- Apartments for Sale in Sector 73 Noida

- Apartments for Sale in Sector 52 Noida

- Apartments for Sale in Sector 51 Noida

- Apartments for Sale in Sector 143 Noida

- Builder Floors for Sale in Sector 107 Noida

- Builder Floors for Sale in Sector 104 Noida

- Builder Floors for Sale in Bhangel Noida

- Builder Floors for Sale in Sector 72 Noida

- Builder Floors for Sale in Divine Meadows Noida

- Builder Floors for Sale in Sector 108 Noida

- Builder Floors for Sale in Gadi Choukhandi Noida

- Builder Floors for Sale in Sector 73 Noida

- Retail Shop for Sale in Phase II Noida

- Retail Shop for Sale in Sector 129 Noida

- Retail Shop for Sale in Sector 94 Noida

- Retail Shop for Sale in Sector 98 Noida

- Retail Shop for Sale in Sector 140 A Noida

- Retail Shop for Sale in Sector 50 Noida

- Retail Shop for Sale in Sector 105 Noida

- Retail Shop for Sale in Sector 110 Noida

- Office Space for Sale in Sector 140 A Noida

- Office Space for Sale in Sector 129 Noida

- Office Space for Sale in Sector 142 Noida

- Showroom for Sale in Sector 98 Noida

- Showroom for Sale in Sector 129 Noida

- Warehouse for Sale in Sector 82 Noida

Explore Properties for Rent in noida:

- Apartments for Rent in Sector 75 Noida

- Apartments for Rent in Sector 137 Noida

- Apartments for Rent in Chhaprauli Bangar Noida

- Apartments for Rent in Noida Extension Noida

- Apartments for Rent in Sector 78 Noida

- Apartments for Rent in Sector 63 Noida

- Apartments for Rent in Sector 74 Noida

- Apartments for Rent in Sector 70 Noida

- Apartments for Rent in Sector 142 Noida

- Apartments for Rent in Sector 48 Noida

- Villa for Rent in Rwa Noida

- Villa for Rent in Sadarpur Noida

- Villa for Rent in Sector 41 Noida

- Villa for Rent in Sector 19 Noida

- Office Space for Rent in Bajidpur Noida

- Office Space for Rent in Sector 142 Noida

- Office Space for Rent in Sector 144 Noida

- House for Rent in Sector 19 Noida

- House for Rent in Sector 142 Noida

- House for Rent in Sector 67 Noida

- Builder Floors for Rent in Sector 122 Noida

- Builder Floors for Rent in Bhangel Noida

- Builder Floors for Rent in Sector 142 Noida

- Retail Shop for Rent in Sector 78 Noida

- Retail Shop for Rent in Sector 106 Noida

- 1 Rk Studio for Rent in Sector 70 Noida

- 1 Rk Studio for Rent in Sector 51 Noida

Explore Plots for sale in noida:

- Plot for Sale Sector 4 Noida

- Plot for Sale Kulesara Noida

- Plot for Sale Phase II Noida

- Plot for Sale Samastpur Noida

- Plot for Sale Sector 16a Noida

- Plot for Sale Sector 17 Noida

- Plot for Sale Sector 128 Noida

- Plot for Sale Bhangel Noida

- Plot for Sale Sector 2 Noida

- Plot for Sale Sector 142 Noida

- Commercial Plot for Sale in Sector 92 Noida

Explore PG’s for Rent in noida:

- PG’s for Rent in Sector 19 Noida

- PG’s for Rent in Sector 15 Noida

- PG’s for Rent in Sector 71 Noida

- PG’s for Rent in Sector 62 Noida

- PG’s for Rent in Sector 137 Noida

- PG’s for Rent in Sector 72 Noida

- PG’s for Rent in Sector 92 Noida

- PG’s for Rent in Sector 27 Noida

- PG’s for Rent in Sector 49 Noida

- PG’s for Rent in Sector 18 Noida

Explore Co-living options in noida:

- Sharing Room/Flats in Sector 75 Noida

- Sharing Room/Flats in Sector 74 Noida

- Sharing Room/Flats in Sector 76 Noida

- Sharing Room/Flats in Sector 70 Noida

- Sharing Room/Flats in Sector 137 Noida

- Sharing Room/Flats in Sector 77 Noida

- Sharing Room/Flats in Sector 51 Noida

- Sharing Room/Flats in Sector 52 Noida

- Sharing Room/Flats in Sector 55 Noida

- Sharing Room/Flats in Sector 134 Noida

- Sharing Room/Flats in Sector 117 Noida

- Sharing Room/Flats in Sector 63 Noida

- Sharing Room/Flats in Sector 92 Noida

Buy, Sell & Rent Properties – Download HexaHome App Now!

Find your perfect home, PG, or rental in just a few clicks.

Post your property at ₹0 cost and get genuine buyers & tenants fast

Smart alerts & search helps you find homes that fit your budget.

Available on iOS & Android

A Product By Hexadecimal Software Pvt. Ltd.